The numbers nobody can ignore

- 90% of venture‑backed start‑ups never return a cent to investors (CB Insights).

- Of the ~400 000 tech companies founded each year world‑wide, barely 0.3% reach USD 100M revenue and only 0.02% become unicorns.

- Median time to an exit is 7–10 years; median founder salary in the first 24 months is under USD 45 000.

That is the part people quote when they want to scare you away. But here is the other side of exactly the same data set:

- Roughly 35 000 new founders every year now build profitable, “calm” SaaS or tech‑enabled services that clear USD 1M ARR without ever touching venture capital.

- Cloud, serverless and low‑code have pushed the average MVP cost from USD 150k a decade ago to under USD 30k for the same scope — an 80% reduction that completely changes the risk math.

- 61% of the S&P 500’s top‑line growth came from companies that were start‑ups less than 12 years earlier (McKinsey Digital). Your future competitors are still in somebody’s garage.

The conclusion is uncomfortable but crystal‑clear: the statistical chance of building the next Stripe is microscopic, yet the probability of building a durable, eight‑figure company has never been higher. Which prize matters to you?

The hidden cost of doing nothing

Boards love to compare a risky start‑up idea with the “safety” of a 9–5 job or a boutique service business. The real comparison should be against disruption:

- In retail, 52% of publicly listed chains that ignored e‑commerce in 2010 are now bankrupt or private‑equity turn‑arounds.

- In insurance, fully digital carriers carved out USD 11B of underwriting profit in five years; the incumbents they displaced were 60‑year‑old “safe” businesses.

- GenAI is on track to wipe out 40 % of repetitive knowledge‑worker tasks by 2030 (Gartner). If you are not building something that rides that wave, you might be standing in front of it.

Put differently: four years spent on the wrong side of technological change can cost you more than four years gambling on a new venture.

Redefining success: path‑to‑profit vs. path‑to‑unicorn

VC expectations have inverted during the post‑2021 capital crunch. A seed round that used to close on “vision” now demands USD 50k+ MRR and unit‑economics proof. The flip side: investors respect efficient growth again, and bootstrapped profitability is fashionable.

Azati sees three repeatable playbooks in 2025:

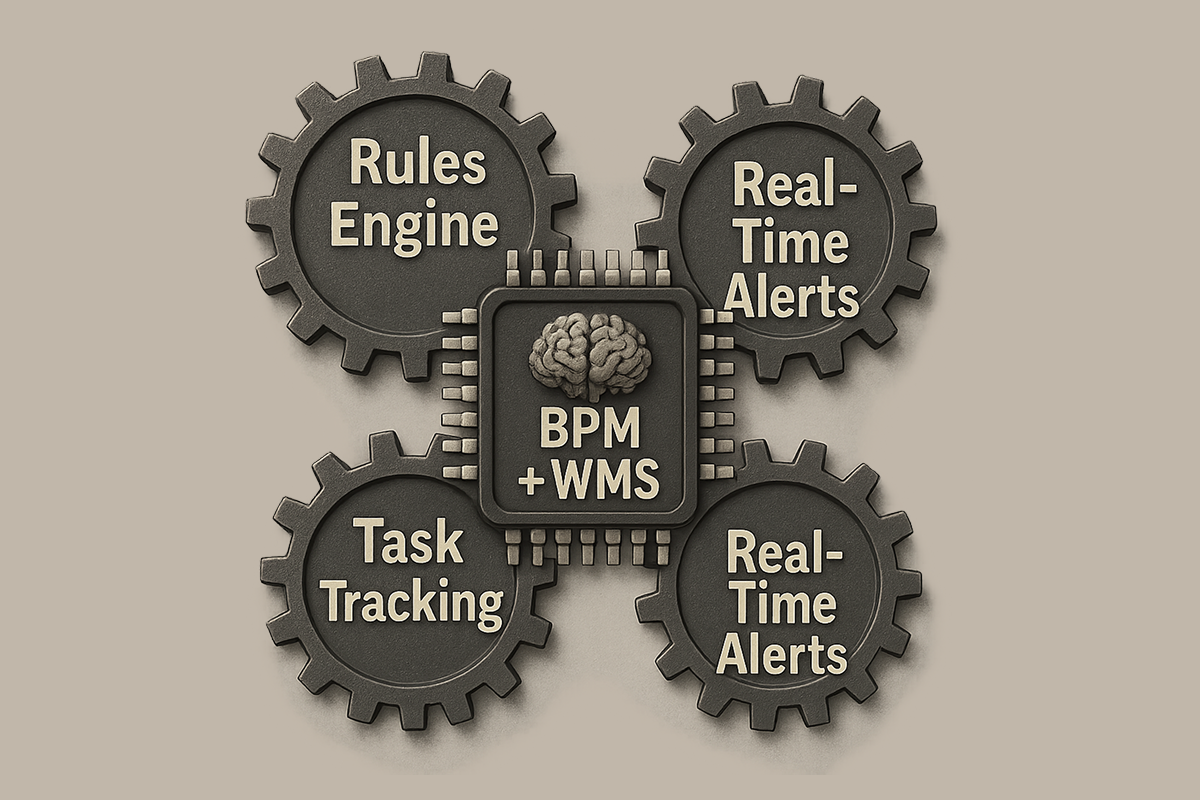

- Laser‑niche B2B SaaS. Solve one painful workflow, charge USD 79–499 per seat. 5–10 enterprise customers yield break‑even.

- API‑first infrastructure. Write the hard integration once, meter usage, let product teams build on top. Gross margin >85%.

- Tech‑enabled services that own proprietary data. Blend consulting revenue with a data asset you later productize.

None requires USD 10M up front, but all can reach eight‑figure valuations on 30–40% year‑over‑year growth.

Technology leverage you didn’t have five years ago

- Generative AI cuts front‑end coding hours by 45% and marketing copy costs by 70%.

- Serverless and micro‑services let a two‑person DevOps crew handle traffic that used to need a 10‑person team.

- Usage‑based cloud pricing means you pay AWS pennies until customers pay you dollars.

- Quick technologies such as Ruby or Python let ship experiments six times faster than enterprise coding.

Translation for decision makers: your capital at risk before the first paying customer is often less than the annual cost of a medium sized team of senior engineers.

A pragmatic decision framework

Step 1 – Point‑blank market validation

Talk to 30 prospects; pre‑sell at least five. If nobody puts a credit card down, stop.

Step 2 – Ruthless runway math

Add business and personal burn. If you cannot survive 18 months at near‑zero salary, either keep your day job longer or raise an angel round that covers the gap.

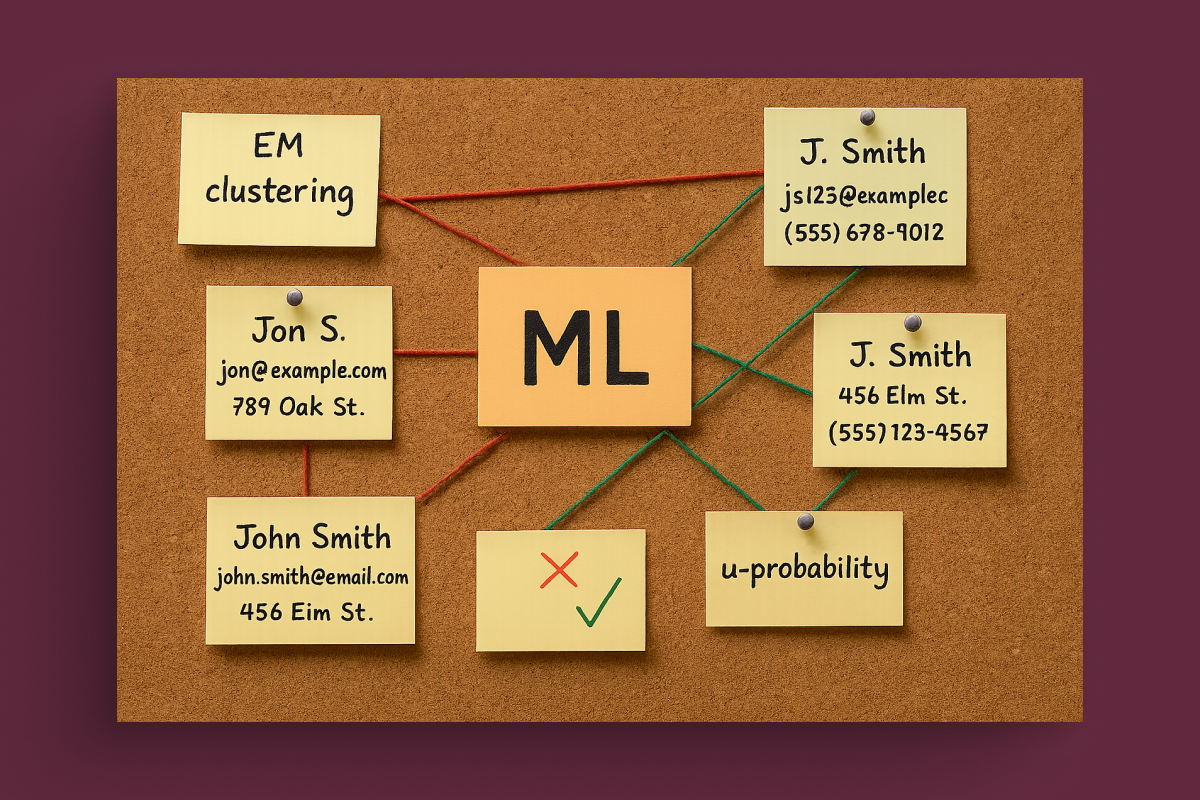

Step 3 – Technical de‑risking sprint

Build a throw‑away prototype in 4–6 weeks. Prove that core IP (algorithm, hardware integration, compliance rule engine) is feasible. Kill the idea immediately if it is not.

Step 4 – Choose funding mode by goal, not ego

Unicorn or nothing? You need venture scale; prepare for dilution and a 10‑year grind.

Financial independence and optionality? Bootstrap or take revenue‑based financing; keep control.

Step 5 – Commit, publicly

Tell customers, advisors, LinkedIn. Social pressure is underrated fuel when the metrics flat‑line on month eight.

When you absolutely should start up

- You keep seeing the same inefficiency and feel physical annoyance that it still exists.

- Early adopters send unsolicited e‑mails asking when they can buy.

- Financial downside is survivable and upside elasticity is uncapped.

Every quarter you wait, somebody else prototypes with ChatGPT, ships, and captures the SEO surface your idea needs. Market doors do not stay half‑open for long.

Azati’s advisory team spends 60 days with prospective founders, pressure‑testing the business case, scoping an MVP. In 2023, 27% of these engagements converted into funded products; 41% pivoted but stayed alive; 32% were intentionally killed – before the founders quit their jobs, before the capital was spent. That is risk management, not romance.

So, is it worth trying to build a startup today?