All Technologies Used

Motivation

The project aimed to develop a scalable and reliable billing management system for public organizations, automating high-volume invoice processing, integration with payment gateways, and reducing manual errors. The solution focused on operational efficiency, robust financial workflows, and seamless external API integration.

Main Challenges

The system had to efficiently process thousands of invoices in scheduled and event-driven batches. Azati implemented Spring Batch and asynchronous integration patterns to handle large-scale financial operations without downtime or bottlenecks.

Handling real-time and asynchronous communications with an external payment gateway required robust error handling and retries. The team implemented Spring Integration flows and retry mechanisms to ensure message delivery and processing.

Business rules varied across clients and had to be validated at multiple stages. Custom validation and calculation layers were developed within the service architecture to ensure accurate billing and compliance.

Our Approach

Want a similar solution?

Just tell us about your project and we'll get back to you with a free consultation.

Schedule a callSolution

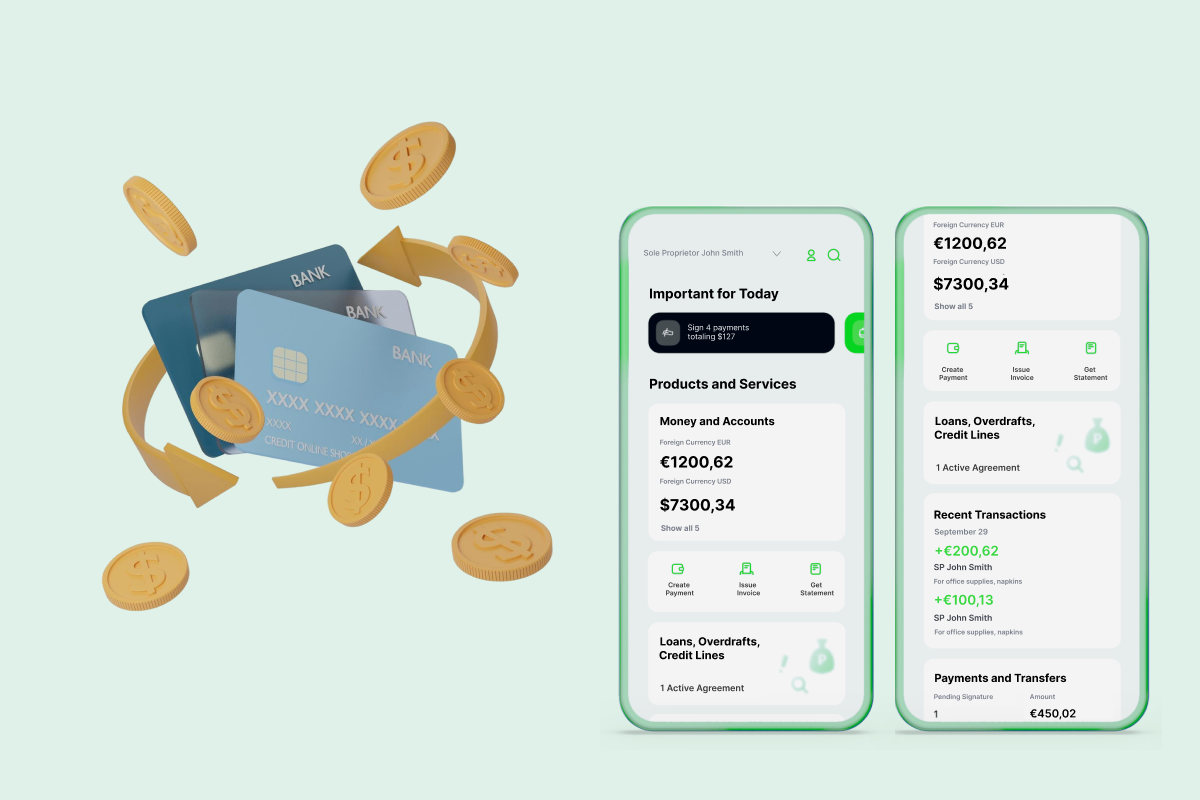

Batch Invoice Processing Module

- High-volume batch processing using Spring Batch

- Retry mechanisms for failed transactions

- Automated payment settlements and reconciliation

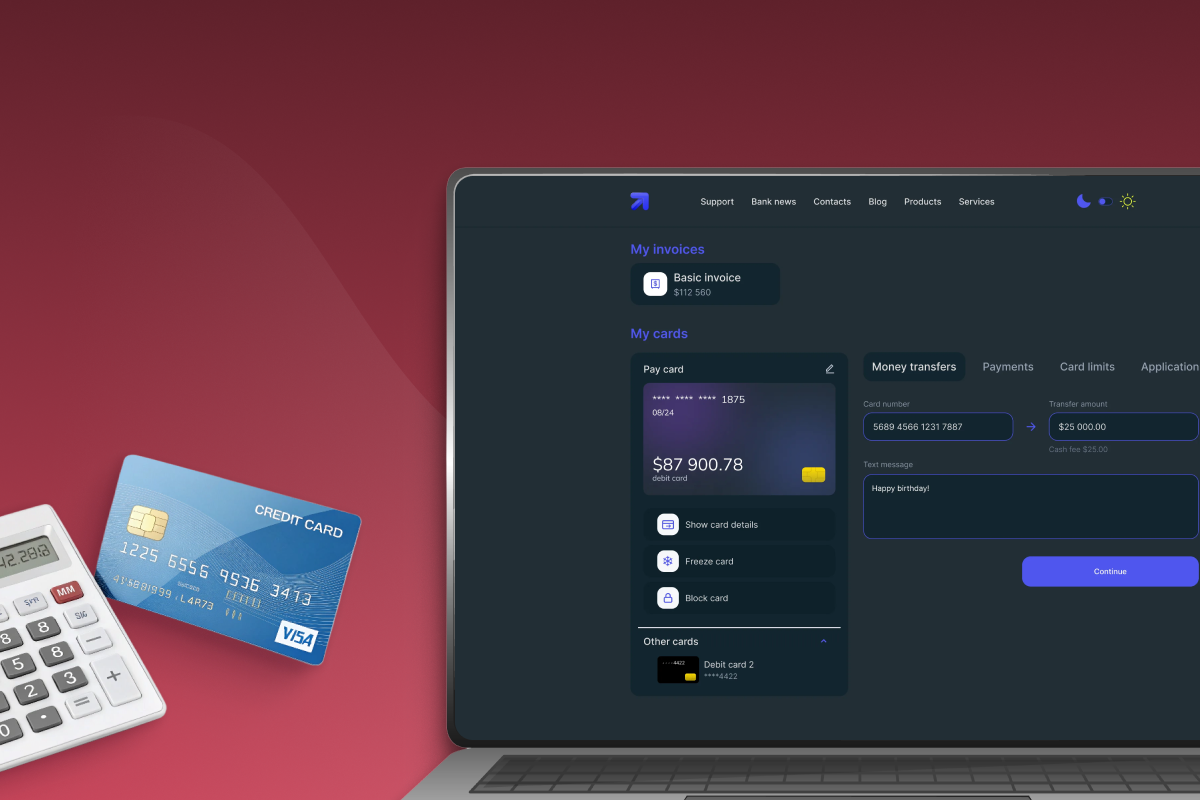

Payment Gateway Integration Module

- Message-based integration for non-blocking communication

- Error handling and automatic retries

- Real-time payment status updates

Business Logic & Validation Module

- Multi-stage validation for invoices and payments

- Custom calculations for different client rules

- Ensures compliance and accurate billing operations

REST API & Integration Layer

- Create, read, update, delete operations for billing and payment entities

- Filter, sort, and search functionality for comprehensive data access

- Supports integration with internal banking systems and third-party services

Business Value

Reliable and Scalable Billing System: The implemented solution successfully handled complex billing needs for public organizations and was capable of scaling with growing demand.

Improved Integration with Payment Gateways: Enabled seamless and secure money transfers, settlements, and automated payment retries through robust integration.

Optimized Business Processes: The automation of key billing processes reduced manual overhead and errors, thereby increasing overall efficiency and customer satisfaction.

Stable Operations through Asynchronous Processing: Reduced system downtime and load peaks with asynchronous communication and batch scheduling.

Knowledge-Driven Development: Regular architectural consultations and team rituals ensured high-quality deliverables aligned with long-term system goals.