All Technologies Used

Motivation

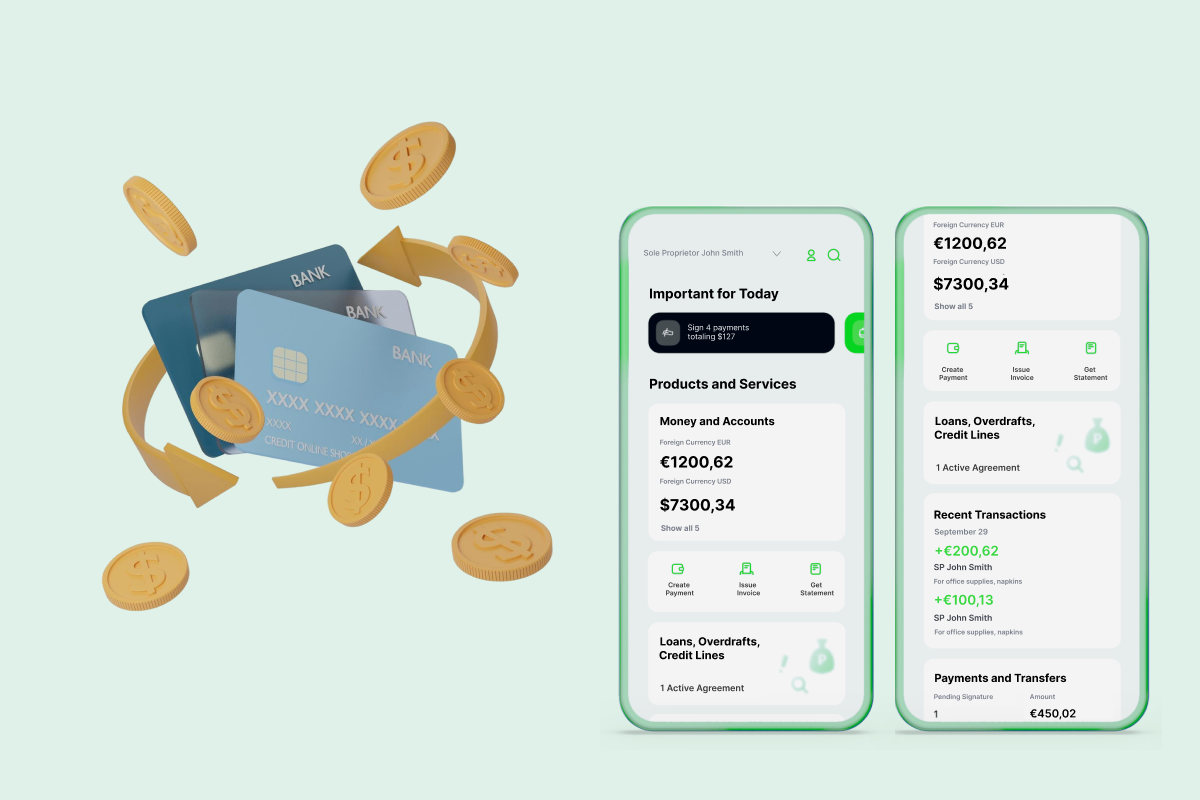

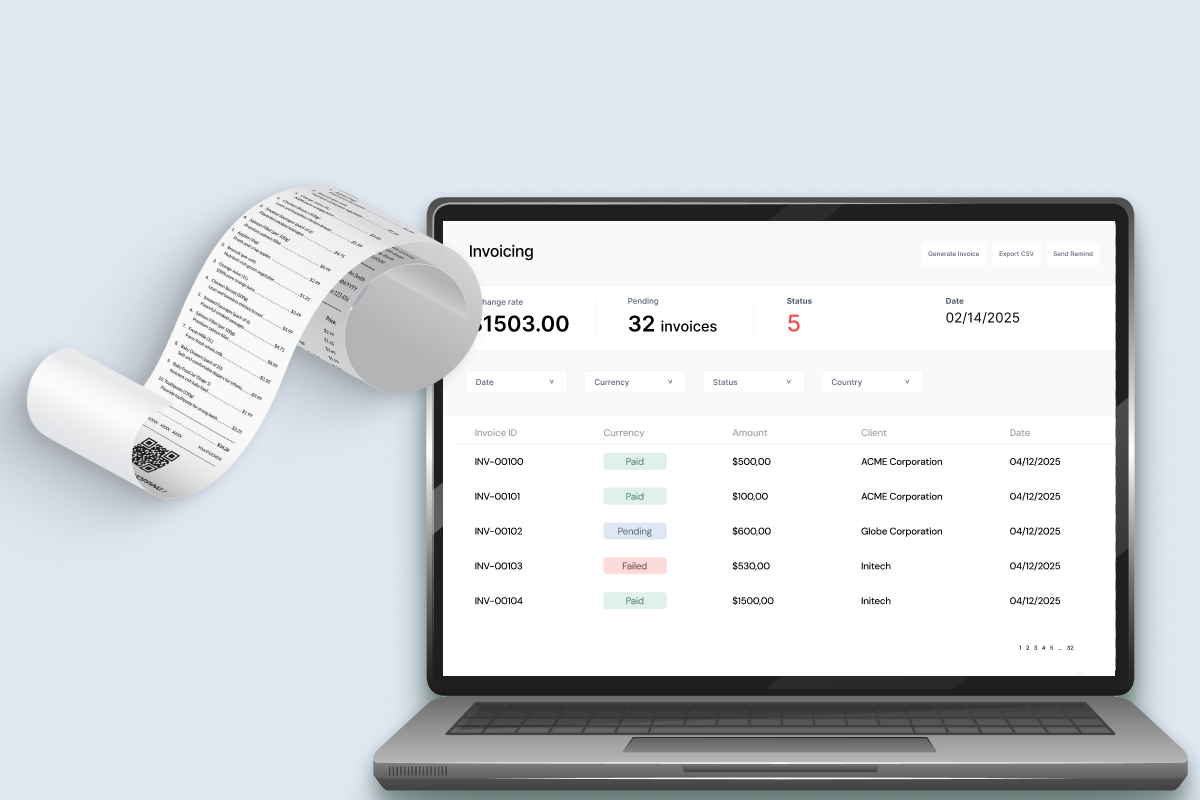

The goal of this project was to develop a backend solution for the bank’s mobile and web banking applications, specifically the ‘tariff calculator’ system. This system calculates clients’ benefits and grants free services when users meet specific goals, such as making transactions, saving a particular amount, or receiving salary payments.

Main Challenges

Due to the bank’s infrastructure, developers had to switch between two VPNs, one for internal development and another for the bank’s mailing system. This made communication with on-site teams complex and increased development time. Azati implemented a structured remote workflow and careful sprint planning to mitigate delays and maintain productivity.

Integrating new microservices into the existing banking system, while maintaining synchronous communication between multiple legacy and external systems, was challenging. Azati proposed a modular architecture with dedicated tariff calculator, queue, configuration, and tariffs catalog microservices, ensuring seamless integration and consistent performance.

Our Approach

Want a similar solution?

Just tell us about your project and we'll get back to you with a free consultation.

Schedule a callSolution

Microservices Architecture

- Full catalog of packages

- User selection tracking

- Integration with tariff calculator

Tariff Calculator

- Automated benefit calculation

- Real-time goal evaluation

- Accurate application of service packages

Queue Microservice

- Event-driven processing

- Synchronous inter-service communication

- Reliable message delivery

Configuration Microservice

- Centralized configuration management

- Dynamic updates without downtime

- Consistency across microservices

Business Value

Automated Client Benefits: Free service packages are applied automatically based on goal fulfillment, reducing manual errors and ensuring consistent application.

Improved Customer Experience: Users can clearly see available packages, track their progress, and receive services promptly, enhancing engagement and satisfaction.

Reliable Integration: Microservices communicate seamlessly with existing banking infrastructure and external systems.

Operational Efficiency: Reduced backend complexity and improved maintainability for future updates.