All Technologies Used

Motivation

To enhance the digital banking platform by delivering new functionality, improving existing services, and ensuring ongoing compliance with Central Bank regulations. The goal was to improve user experience, increase customer engagement, and maintain system stability.

Main Challenges

The client required rapid development of new features for mobile and internet banking to meet user demands. Azati developed and integrated new services, improving the user interface and security of the digital banking products.

Frequent changes in regulatory requirements from the Central Bank necessitated constant updates to the system. Azati implemented timely regulatory updates to ensure the platform remained compliant and audit-ready.

Frequent issues in the production environment impacted the stability of the platform. Azati provided quick defect resolution within SLA timelines, ensuring minimal downtime and uninterrupted service.

Our Approach

Want a similar solution?

Just tell us about your project and we'll get back to you with a free consultation.

Schedule a callSolution

Monolithic Architecture with Layered Structure

- Layered design for modular development

- Clear separation of presentation, business, and data access logic

- Facilitates future upgrades and integrations

- Supports stable and secure operation

Presentation Layer

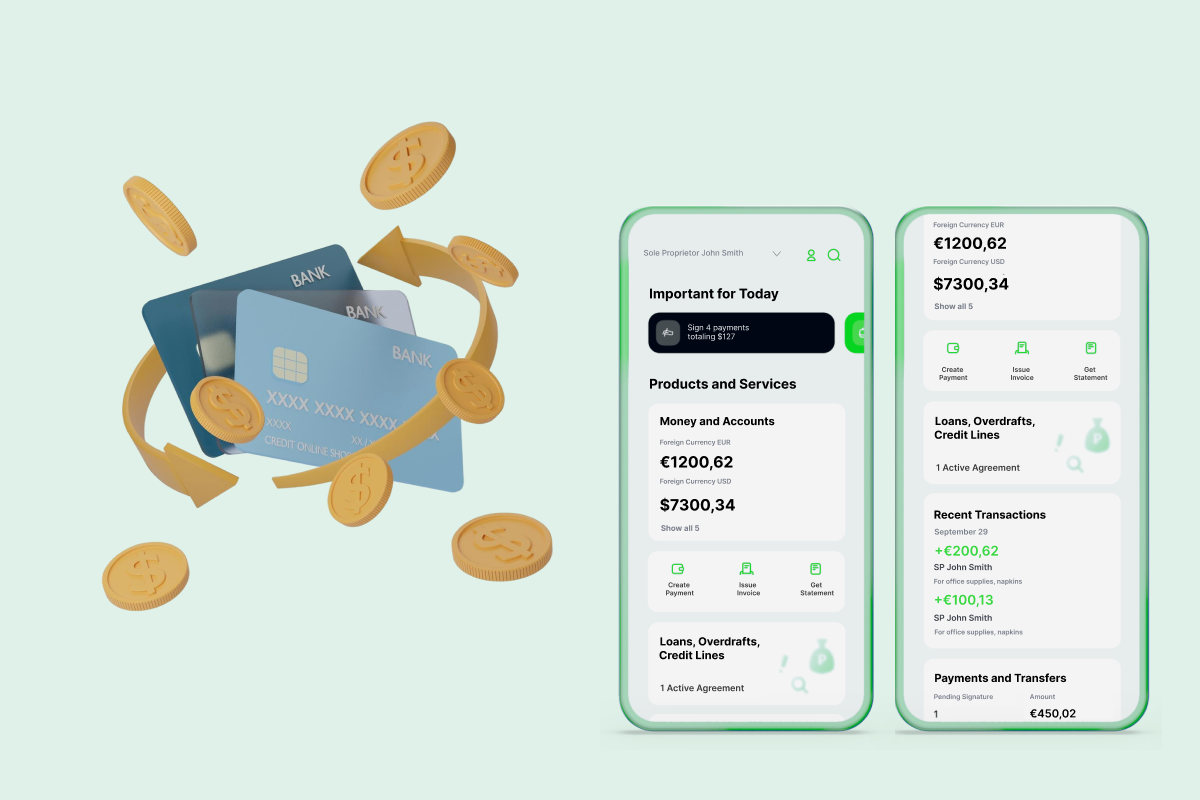

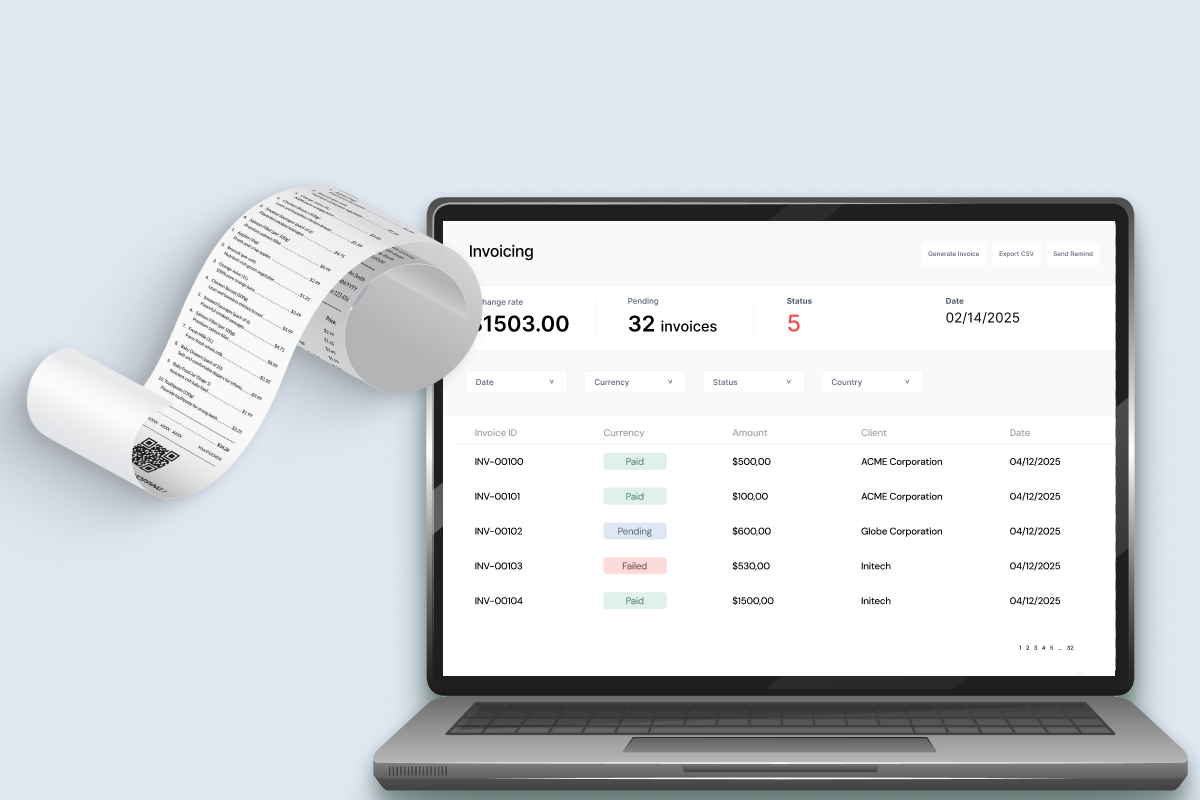

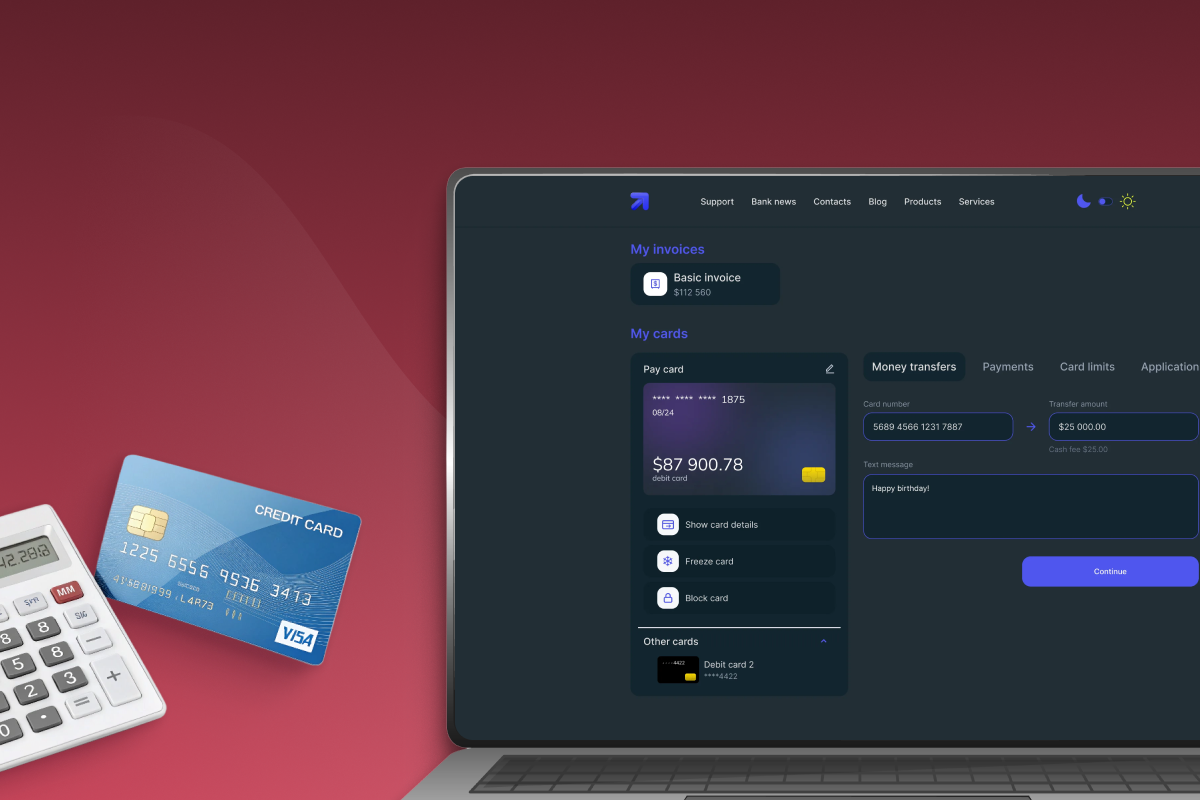

- Intuitive user interface for web and mobile apps

- Access to account management, transfers, and payments

- Responsive design for multiple devices

- Enhanced user experience and engagement

Business Logic Layer

- Secure and efficient transaction processing

- Data validation and business rule enforcement

- Supports new functionality for digital banking

- Integrates with regulatory compliance rules

Data Access Layer

- Efficient database access using Oracle and Hibernate

- High-speed queries and transaction handling

- Secure data storage and retrieval

- Integration with backend systems and APIs

Performance, Security, and Reliability Enhancements

- Optimized queries for faster transaction processing

- SLA adherence and defect resolution

- Security measures for data protection

- High reliability and uptime for banking services

Business Value

Improved Performance through Query Optimization: Query optimization significantly accelerated transaction processing, improving overall system performance and reducing wait times for users, which enhanced user satisfaction.

Compliance with Regulatory Requirements and Uninterrupted Service Operation: We ensured full compliance with Central Bank regulations, avoiding penalties and guaranteeing stable operation of remote banking services without disruptions, strengthening customer trust.

Increased Customer Engagement through New Functionality: The integration of new services enhanced the convenience and functionality of mobile applications and online banking, leading to increased user engagement and loyalty.

SLA Adherence and Defect Resolution: We successfully adhered to the Service Level Agreement (SLA), promptly addressing defects and minimizing system downtime, ensuring high stability and reliability of all banking services.

Long-term Technical and Operational Benefits: As a result of our collaboration, the client gained not only a technically updated and high-performance system but also confidence in the system's ability to support the company's growth and adapt to future challenges.