All Technologies Used

Motivation

The customer faced the challenge that many users did not have access to smartphones or charged devices, which limited their ability to use online banking services. Azati's goal was to develop a web version of the mobile application that would provide universal access to all banking functionalities, including account management, payments, transfers, and transaction history, from any internet-connected device. The solution needed to maintain a consistent design with the mobile app, improve usability, streamline workflows, and reduce user frustration caused by the lack of a web platform.

Main Challenges

A significant portion of the bank's users did not have smartphones or often had uncharged devices, which prevented them from accessing essential banking services through the existing mobile app. This gap risked excluding users from online services and caused frustration among customers.

Initial mismanagement led to unclear task assignments, overtime, and duplicated efforts within the development team. Inefficient communication between managers caused repeated approvals and delays, which slowed down the development process.

The web version needed to match the design and functionality of the mobile application to provide a seamless experience. Adapting mobile UX/UI for web, ensuring all features were accessible, and maintaining a consistent design language across platforms posed significant design and technical challenges.

The project required integrating multiple banking functions: payments, transfers, card limits, transaction history into a single coherent interface. This demanded careful planning of user flows and interaction patterns to reduce confusion and ensure intuitive navigation.

Close collaboration with the frontend team was necessary to implement the design correctly. Differences in technical implementation and limitations of the existing codebase required constant adjustments and alignment between design and development teams.

Our Approach

Want a similar solution?

Just tell us about your project and we'll get back to you with a free consultation.

Schedule a callSolution

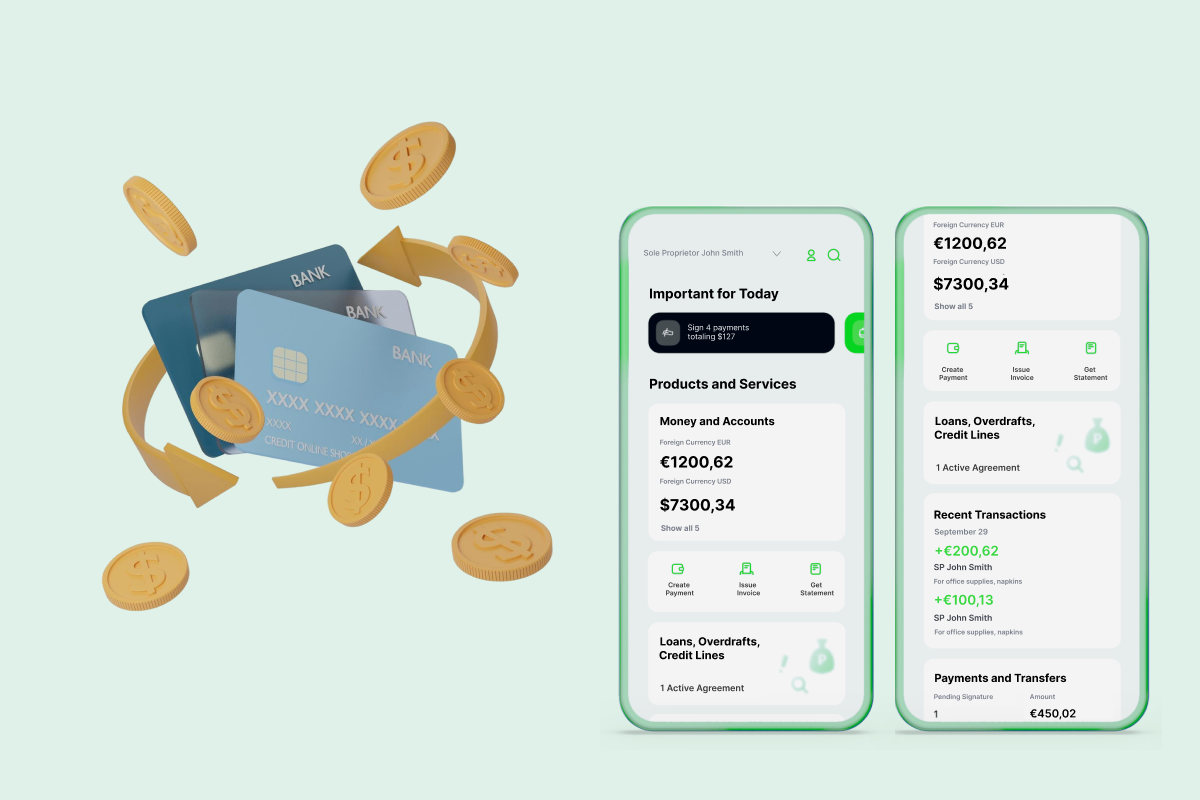

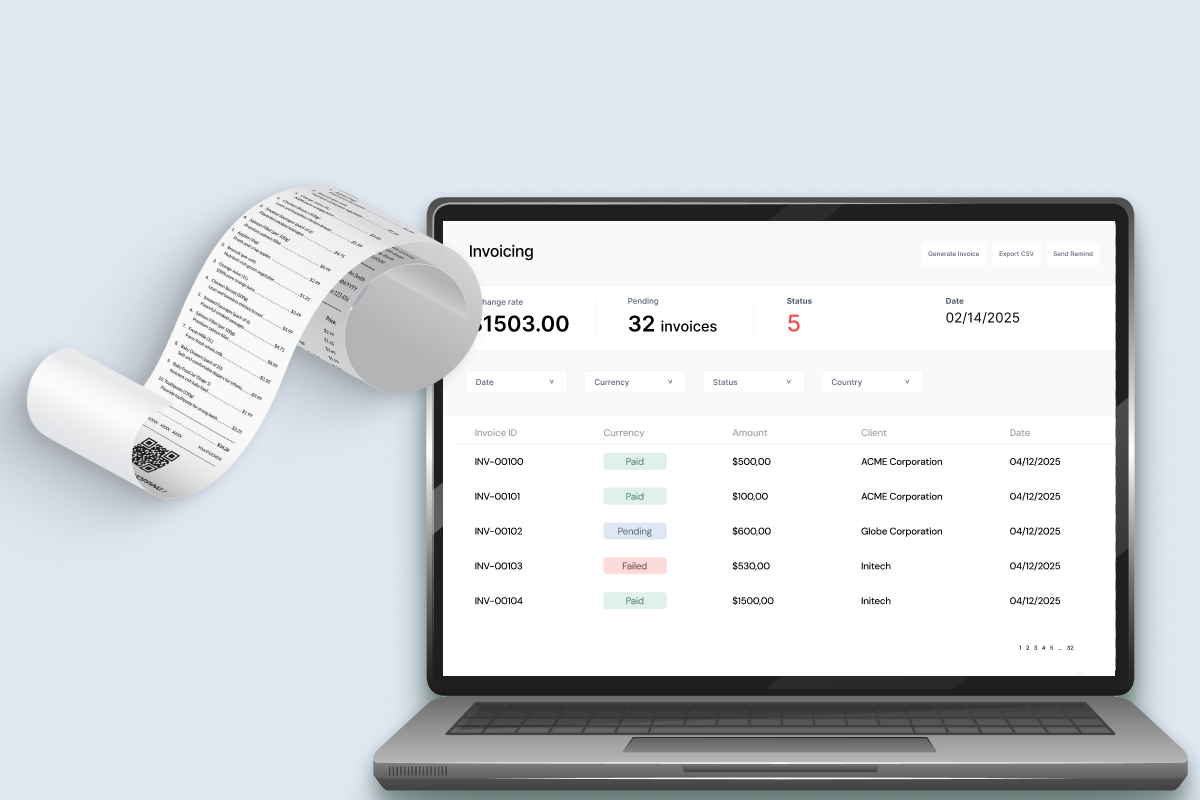

Admin Dashboard

- Switching between payments, transfers, card limits, and transaction history with a single click

- Clear visualization of account balances and recent activities

- Centralized management of banking operations to improve user efficiency

- Supports both web and mobile interfaces seamlessly

Cross-Platform Consistency

- Maintains consistent UI/UX elements across web and mobile

- Preserves user familiarity when switching devices

- Reduces learning curve for users accessing new platforms

- Enables smooth integration of future updates across platforms

Responsive Design

- Adapts UI to different resolutions and aspect ratios

- Improves accessibility for users on older or low-spec devices

- Ensures all functions remain usable and visually coherent

- Supports modern browsers as well as legacy ones for wider reach

Improved UX Journey

- Consolidates payments, transfers, and account management in a single flow

- Minimizes clicks and navigation steps for frequent operations

- Enhances intuitiveness for first-time users

- Reduces errors and confusion during banking operations

UI Kit Creation

- Provides a library of pre-designed buttons, tables, forms, and icons

- Facilitates faster implementation of new features

- Maintains design consistency across the platform

- Enables easy scaling and adaptation for future updates

Business Value

Enhanced User Accessibility: Users can now access banking services from any device, including desktops and tablets, improving service availability.

Reduced Operational Costs: Streamlined and automated banking operations led to savings in manual processing and support.

Improved User Experience: Modernized UX/UI reduced confusion and increased efficiency for performing banking tasks.