All Technologies Used

Motivation

The client approached Azati to automate the insurance application process, aiming to minimize manual paperwork, ensure accurate and complete data submission, and allow customers to submit forms and receive quotes quickly and reliably at any time.

Main Challenges

The traditional application process required extensive manual handling, including faxed forms, data transfer into multiple storage systems, and verification by various specialists such as customer service managers and data validators, leading to delays, increased costs, and high risk of errors that impacted client satisfaction and productivity.

Clients often submitted incomplete or inconsistent information, which required time-consuming reviews and manual corrections, compromising efficiency, delaying premium estimation, and sometimes resulting in rejection or rework of applications.

The client needed a solution capable of handling high submission volumes at any time of day, supporting users across multiple time zones without overloading internal staff, ensuring scalability, reliability, and continuous business operation.

Our Approach

Want a similar solution?

Just tell us about your project and we'll get back to you with a free consultation.

Schedule a callSolution

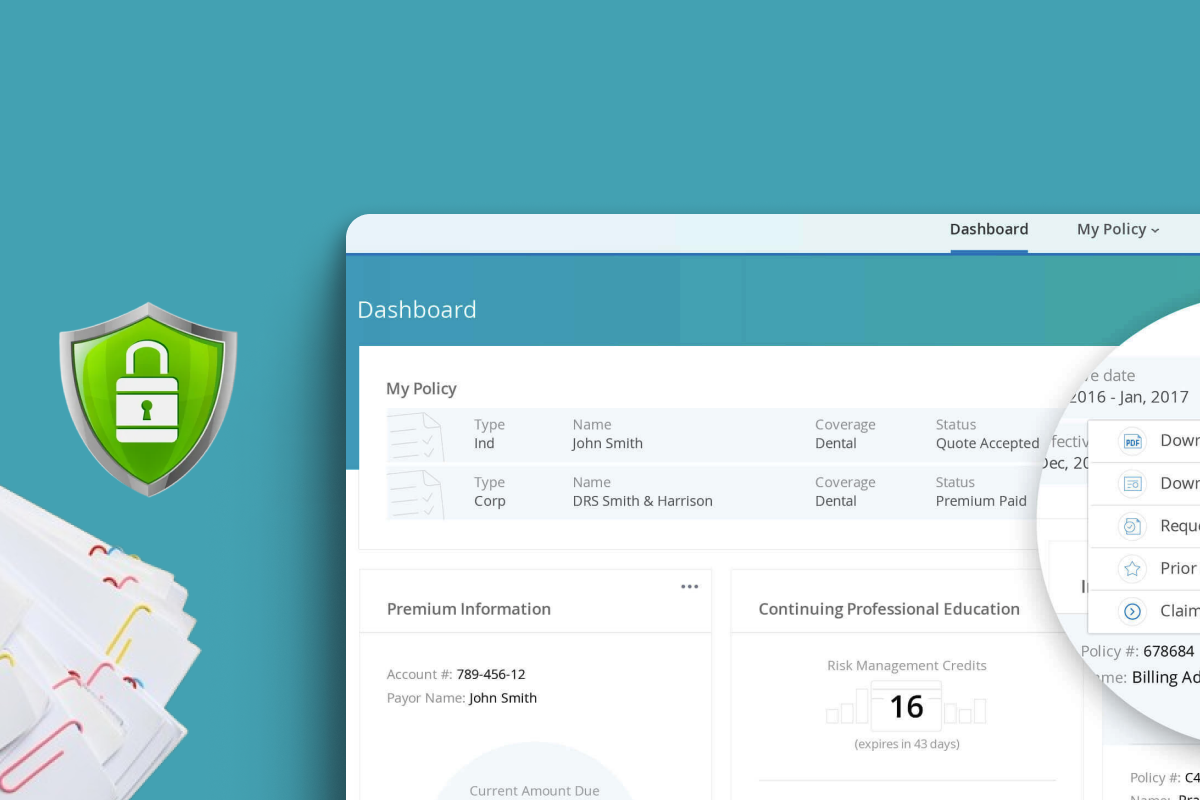

Self-Completion and Submission

- Clients can fill out and submit applications without assistance

- Automates data capture and ensures all required fields are completed

- Reduces reliance on staff for manual entry

- Speeds up the application-to-quote workflow

- Improves data consistency and quality

24/7 Availability

- Submit or modify applications at any time

- Support customers in different time zones

- Reduce dependency on office hours

- Enable immediate processing of urgent applications

- Improve customer satisfaction through accessibility

Business Rule Validation

- Verify insurance eligibility and coverage requirements

- Check for missing or inconsistent information

- Prevent invalid submissions

- Reduce manual review and correction effort

- Improve overall process reliability

Automated Premium Estimation and Quote Generation

- Generate accurate insurance quotes in real-time

- Reduce manual calculations and potential errors

- Provide immediate feedback to customers

- Support multiple coverage options and plan types

- Integrate seamlessly with the business workflow

E-Signature and Document Attachment

- Capture legally valid digital signatures

- Attach PDFs and other necessary documentation

- Reduce paper-based processes

- Ensure secure and auditable submission records

- Streamline approval and processing

PDF Generation

- Create PDF copies of submitted applications automatically

- Support internal recordkeeping and compliance

- Facilitate offline review or sharing

- Ensure documents are formatted consistently

- Enhance transparency and reporting

Business Value

Increased Efficiency: The automation of the application process significantly reduced the time required for data entry and submission, leading to faster quote approvals and policy issuance.

Cost Reduction: By eliminating manual paperwork and reducing human involvement, the customer saved on operational costs, while also improving accuracy.

Stronger Customer Experience: Clients now receive faster service and can submit applications at their convenience, improving customer satisfaction.

Increased Sales and Detection of Potential Clients: The system's streamlined process and automated communications resulted in higher submission ratios and greater success in detecting potential clients.