All Technologies Used

Motivation

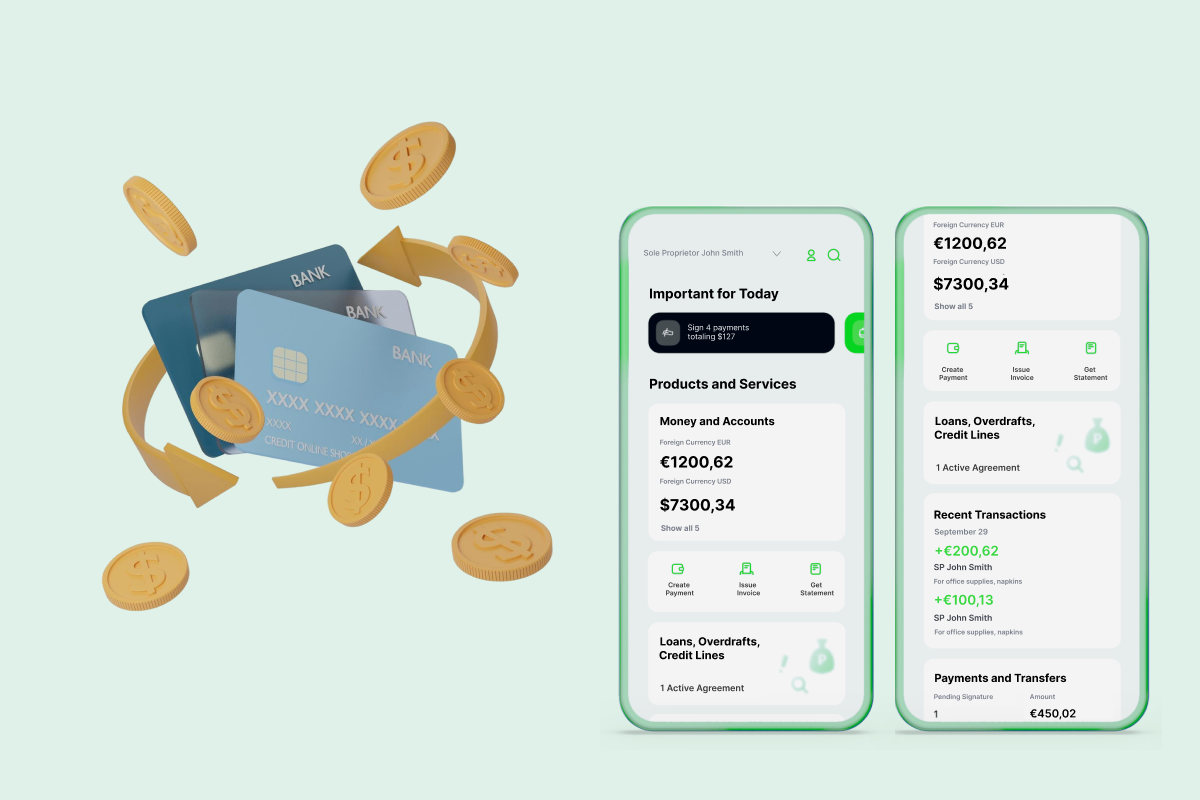

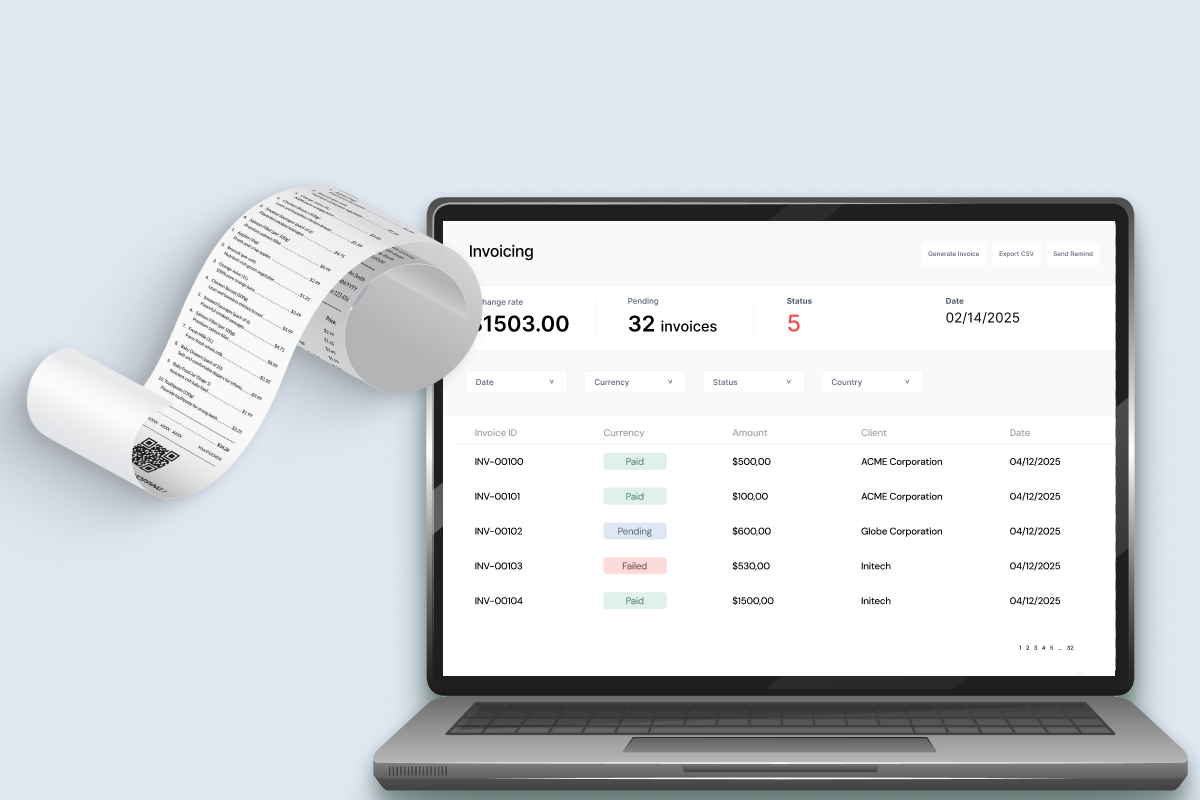

The goal was to develop a new version of an online banking platform that included both a web version and a mobile application API. Azati was responsible for developing the web version, including both customer-facing interfaces and server-side logic, and creating the mobile API for the banking platform.

Main Challenges

Initially, the release workflow was poorly organized, and necessary Git permissions were invalid. As the project grew, this became critical. Azati’s involvement helped reorganize the workflow, allowing for timely delivery of results.

Online banking integrates with various third-party services (e.g., for money transfers to other banks' clients). The team worked proactively with external vendors to understand their services and find optimal integration solutions.

The project suffered from poor performance due to unnecessary code and inefficient workflow. Azati helped establish a reliable workflow, refactor outdated classes, eliminate redundant verifications, and introduce automated tests.

Our Approach

Want a similar solution?

Just tell us about your project and we'll get back to you with a free consultation.

Schedule a callSolution

User Interface (UI)

- Responsive web interface for desktop and mobile devices

- Clear navigation and account overview

- Support for transaction history, bill payments, and fund transfers

- Integration with backend API for real-time data updates

Backend API

- User authentication and role-based access control

- Data validation and error handling

- Efficient processing of API requests for account data

- Secure communication with main API and database layer

Main API and Business Logic

- Processing of account operations and transaction requests

- Integration with internal banking middleware

- Execution of business rules for transactions, balances, and reporting

- Scalable architecture to handle high loads

Integration Layer

- Integration with external payment and banking APIs

- Routing requests securely to third-party services

- Monitoring and logging of integration activities

- Adaptable to new partners without major architecture changes

Business Value

Faster Operations: Optimized backend and API improved transaction processing speed up to 6x.

Improved Reliability: Clear workflow and SCRUM methodology reduced errors and increased code quality.

Enhanced User Experience: Intuitive UI and responsive web design provided seamless access to banking features.

Integration Readiness: Secure API and integration layer enabled smooth connectivity with third-party services.

Scalable Architecture: Monolithic architecture scaled to multiple servers, ensuring stable performance under increased load.