Introduction: The Rise of AI-Powered Trading Predictions

The ability to predict financial market movements is crucial, especially in today's fast-paced economy where milliseconds can mean millions in profit or loss. Traditional market analysis, which relies on historical data and human expertise, is increasingly being enhanced or replaced by artificial intelligence (AI). AI-driven real-time data analysis is revolutionizing financial market forecasting, enabling traders and investors to make more informed decisions with unprecedented speed and accuracy.

How does AI in financial analysis work with real-time data? In this comprehensive article, we explore how AI is transforming trading predictions and financial market forecasting, covering key technologies, methodologies, and real-world applications that are reshaping the finance industry in 2025. We'll dive deep into machine learning techniques, high-frequency trading strategies, and how quantitative hedge funds leverage these technologies for competitive advantage.

The Power of Real-Time Data Analysis in Modern Finance

AI leverages various machine learning techniques and advanced data analytics to dramatically improve financial market analysis and predictions. The combination of real-time data analytics with sophisticated artificial intelligence algorithms enables financial institutions to process massive volumes of market data, news feeds, social media sentiment, and economic indicators instantaneously.

Data analysis with machine learning in finance operates on multiple levels: it identifies patterns invisible to human analysts, predicts market volatility before it occurs, executes trades in microseconds, and continuously adapts to changing market conditions. This creates a powerful feedback loop where AI prediction models become more accurate with each transaction.

AI Technologies Driving Market Predictions

Machine Learning Algorithms: The Foundation of AI Prediction

Supervised Learning in Financial Markets

The financial sector employs a variety of supervised learning algorithms for a different range of roles including credit scoring, fraud detection, and stock price prediction. These algorithms train predictive models on massive amounts of historical financial data to estimate the creditworthiness of loan applicants, flag fraudulent transactions as they occur, and predict stock prices in the future using advanced AI prediction techniques.

Because new financial data is consistently becoming available, these models continuously update to improve their accuracy in predicting market movements and ensuring efficient operation within the ever-changing trends of the financial world. This is a core component of how AI platforms analyze financial market trends in real-time.

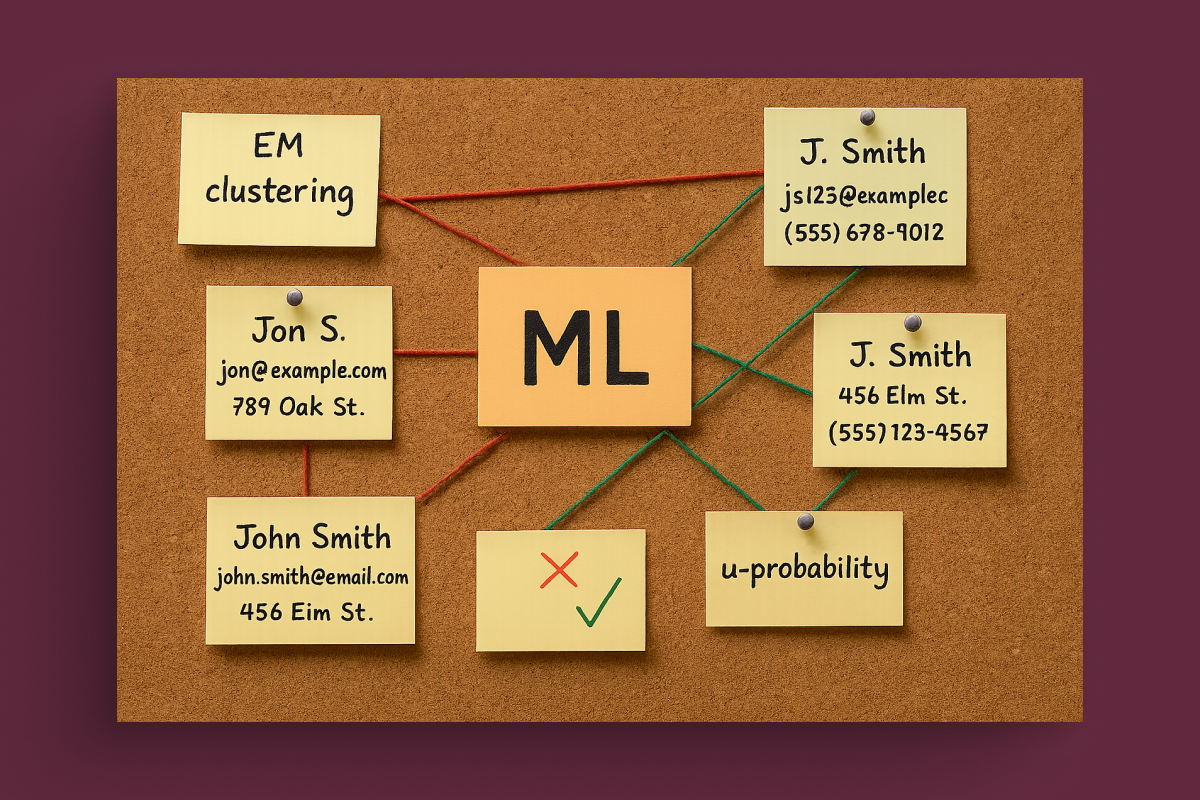

Unsupervised Learning: Pattern Discovery

In finance, unsupervised learning algorithms have demonstrated profitable results by clustering similar financial instruments, identifying anomalies, and extracting latent market patterns from data without pre-labeled datasets.

For example, it can group together stocks with common performance attributes, find suspicious trading behavior that could be indicative of fraud or market manipulation, and uncover shifts in customer behavior or investment strategy. This ability to find trends without having to have established labels makes unsupervised learning a useful tool for financial analysts, portfolio managers, and anyone working with real-time data analytics.

Reinforcement Learning: Adaptive Trading Strategies

Reinforcement learning models deal with dynamic and complex environments, something that markets in the financial sector most undoubtedly are. These models undergo trial and error training to speculatively learn optimal trading strategies, adjusting their actions based on market feedback to optimize returns through sophisticated AI-powered trading systems.

In algorithmic trading, this approach is useful because the models can execute trades on their own, adapt to changing markets, and refine their strategies as more data becomes available. Moreover, in portfolio management, reinforcement learning is used to calibrate asset weights and in risk management to construct an investment portfolio that balances expected returns with potential losses.

Natural Language Processing (NLP): Understanding Market Sentiment

NLP in news articles, social media posts, earnings calls, and financial reports is how AI can read and understand human language to enhance trading predictions. This process allows NLP models to both grasp the sentiment and extract important and relevant information which in turn help in predicting the movement of the market based on news and public sentiment.

In finance, NLP applications are used to analyze earnings call transcripts, SEC filings, and broker reports to find new insights and trends. This technology enables real-time trading strategies, risk management, and portfolio optimization through a better understanding of market dynamics and investor behavior.

Deep Learning: Complex Pattern Recognition

Deep learning models, by using neural networks with many layers, can analyze complex data sets with a high number of dimensions. Because they can identify very complex patterns and relationships that standard analytics processes would overlook, deep learning can really help in the field of finance with advanced AI prediction capabilities.

This opens up a variety of use case possibilities, such as predicting stock prices, credit scoring, or fraud detection. Deep learning models scour large troves of historical prices, transaction records, news items, and alternative data sources to spot changing trends or anomalies that can guide decisions regarding investment strategies, risk management, and portfolio allocation.

In addition, the capacity of these models for learning and adapting continuously is second to none when it comes to navigating through the dynamically altering financial markets, making them essential for modern AI-powered trading predictions.

| AI Technology | Primary Application | Speed | Accuracy Range |

|---|---|---|---|

| Supervised Learning | Stock price prediction, credit scoring | Medium | 80-90% |

| Unsupervised Learning | Pattern discovery, anomaly detection | Medium-Fast | 75-85% |

| Reinforcement Learning | Adaptive trading strategies | Real-time | 85-95% |

| Deep Learning | Complex pattern recognition | Fast | 88-96% |

| NLP | Sentiment analysis, news interpretation | Real-time | 82-92% |

Applications of AI in Financial Market Predictions

High-Frequency Trading (HFT): Speed Meets Intelligence

What is high-frequency trading? High-frequency trading (HFT) is a type of algorithmic trading characterized by high speeds, high turnover rates, and high order-to-trade ratios. AI-powered algorithms execute trades at extremely high speeds, often in microseconds, capitalizing on minute market fluctuations and price inefficiencies.

Real-time data analysis allows these HFT algorithms to make split-second decisions, maximizing profit potential while managing risk through sophisticated risk management systems. Modern high-frequency trading systems process millions of data points per second, identifying profitable opportunities that exist for mere fractions of a second.

High-frequency trading firms using AI-powered trading predictions can identify and exploit arbitrage opportunities across multiple exchanges simultaneously, generating consistent profits through market-making and statistical arbitrage strategies.

Sentiment Analysis: Predicting Markets Through Public Mood

By analyzing the sentiment expressed in news, social media, financial blogs, and analyst reports, AI models can predict market movements based on public mood and reactions to events through advanced AI prediction techniques. Positive sentiment might indicate a potential rise in stock prices, while negative sentiment could signal a downturn.

Sentiment analysis tools powered by NLP monitor millions of sources 24/7, providing traders with real-time insights into market psychology. This represents a key aspect of how AI platforms analyze financial market trends beyond traditional metrics.

Risk Management: Predicting and Mitigating Market Volatility

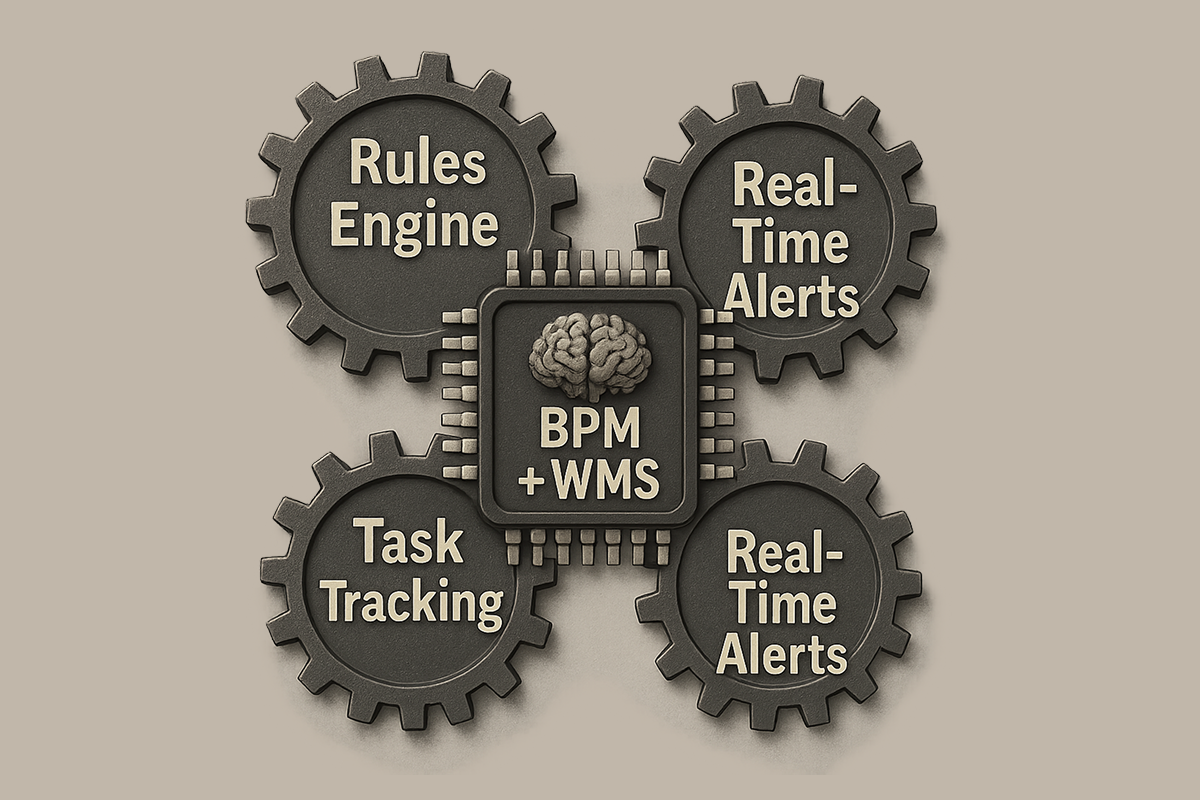

AI models assess market risk by real-time data analysis and predicting potential market volatility before it materializes. This helps financial institutions manage their exposure and make informed decisions to mitigate risk through proactive hedging strategies and position adjustments.

Advanced risk management systems use machine learning to calculate Value at Risk (VaR), stress testing scenarios, and portfolio sensitivity in real-time, enabling faster and more accurate risk assessment.

Portfolio Management: Dynamic Asset Allocation

AI-driven analysis enables dynamic portfolio adjustment based on real-time market conditions. This ensures that investment strategies remain aligned with current market trends and opportunities through continuous portfolio optimization.

Robo-advisors and automated portfolio managers leverage AI-powered trading predictions to rebalance portfolios, select optimal asset allocations, and maximize risk-adjusted returns without human intervention.

Case Studies and Real-World Examples

Quantitative Hedge Funds: Renaissance Technologies

One of the premier quantitative hedge funds is Renaissance Technologies, founded by mathematician Jim Simons. It uses complex mathematical models and algorithms to execute trades and has been extremely successful. The firm frequently emphasizes its use of artificial intelligence (AI) and machine learning (ML) to analyze large swaths of real-time data including market prices, economic releases, as well as alternative data sources such as weather patterns and news articles.

As a result, the Medallion Fund, Renaissance's flagship fund, gained approximately 39% per year between 1988 and 2018 after fees, making it one of the most successful hedge funds in history. The efficacy of Renaissance is often attributed to its cutting-edge AI technology, which is deployed to spot faint patterns and trends too nuanced for human traders to discern using advanced AI prediction models.

Machine learning and related technologies such as neural networks, natural language processing (NLP), and deep learning are used to strengthen predictive models and trading strategies. This exemplifies how AI platforms analyze financial market trends at scale.

Investment Banks: Goldman Sachs and AI Integration

The global investment bank, Goldman Sachs, is actively using AI for its trading and investment activities. The bank uses AI to analyze vast datasets in order to predict market trends and improve trading strategies. Artificial Intelligence is used in the bank for high-frequency trading (HFT), risk management, and portfolio management.

Marquee, Goldman Sachs' AI-driven trading platform, offers clients real-time access to market analysis, trading signals, and algorithmic trading capabilities. Such integration with AI enables the execution of trades more efficiently and faster, lowering operational costs and improving client services.

The bank benefits from the speed and high informational level of AI algorithms, which significantly improves its competitive position in capital markets. This demonstrates how does AI in financial analysis work with real-time data in institutional settings.

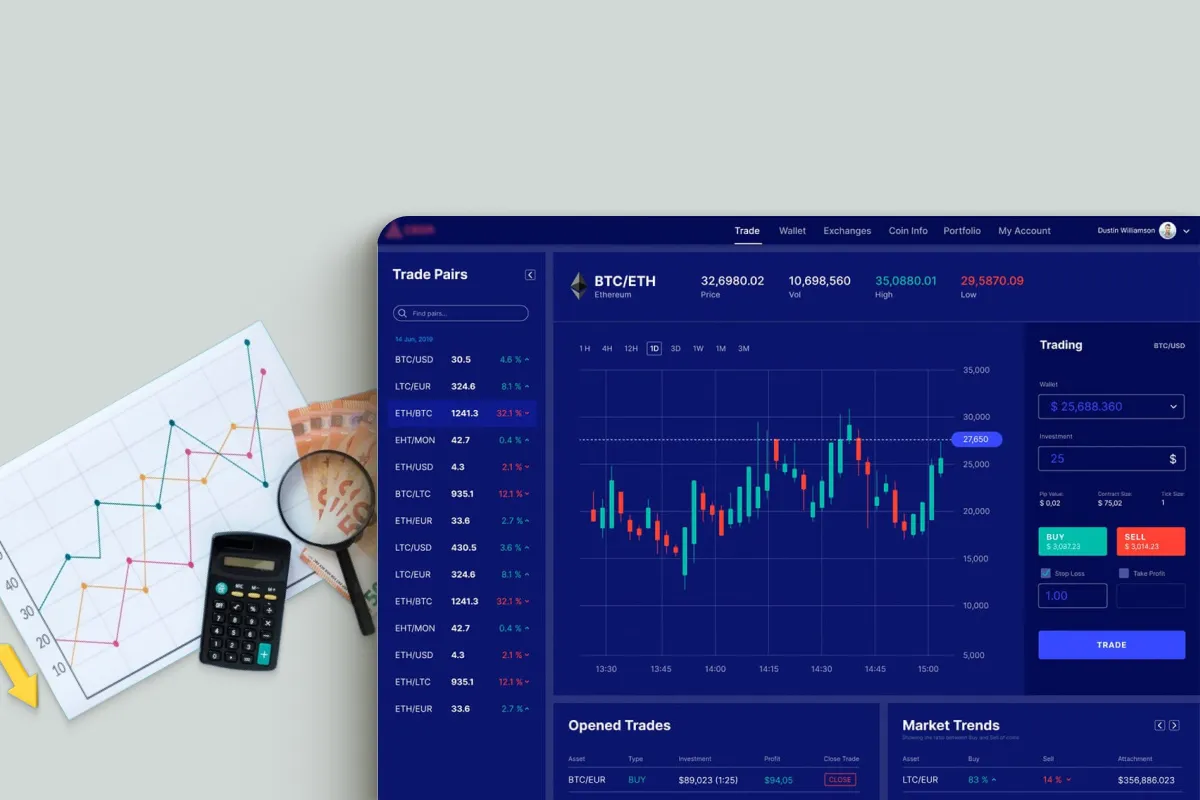

Retail Trading Platforms: Democratizing AI-Powered Trading

Robinhood is a popular retail trading platform which provides commission-free trades and has been very popular among retail investors, particularly millennials and Gen Z traders. AI and machine learning analyze user behavior and provide personalized investment suggestions as well as the detection of fraudulent activities.

AI at Robinhood effectively handles high-throughput trade and user-interaction volumes. The intelligence in AI reduces trading risks and allows users to analyze their propensity towards trading, identify possible market opportunities, and assess their risk tolerance.

This is democratizing the type of market analysis tools that previously were available only to institutional investors. Robinhood also provides AI-based chatbots and virtual assistants that assist users in learning basic trading concepts and navigating the platform with greater ease, making AI-powered trading accessible to everyone.

Challenges and Ethical Considerations

Artificial Intelligence (AI) offers substantial benefits for trading predictions and market analysis, but also presents significant challenges and ethical concerns that must be carefully managed in the finance sector:

Data Governance and Quality

Data Quality and Integrity: Ensuring accurate and reliable data is crucial for AI models to function correctly and ethically in financial market applications. Poor data quality can lead to flawed predictions and significant financial losses.

Privacy and Security: Privacy and Security: Protecting personal and financial data from breaches and unauthorized access is essential as AI relies heavily on sensitive information for real-time data analysis. Cybersecurity threats targeting trading systems have increased by 238% since 2020.

Bias Mitigation: Addressing biases in AI algorithms to prevent unfair treatment based on factors like race, gender, or socioeconomic status in credit decisions and investment recommendations.

AI-Driven Market Manipulation Risks

Algorithmic Trading: AI's role in high-frequency trading can lead to market instability, flash crashes, and unfair advantages without proper oversight and regulatory frameworks.

Consumer Manipulation: AI-powered analytics can exploit consumer behavior for manipulative marketing practices or predatory lending strategies.

Transparency and Accountability

Explainability: Ensuring AI decisions in trading predictions are understandable and transparent to users, stakeholders, and regulators. Black box algorithms create significant challenges for regulatory compliance.

Responsibility: Determining accountability for AI decisions and actions remains a complex ethical challenge when automated systems make trades worth millions without human intervention.

Ethical Use and Social Impact

Employment Displacement: Automation by AI in finance raises concerns about job loss among traders, analysts, and other finance professionals, with an estimated 200,000 jobs potentially affected globally by 2030.

Market Access Inequality: AI-powered trading technologies may create advantages for large institutions over individual investors, potentially widening wealth gaps.

Systemic Risk: The interconnected nature of AI systems across financial markets could amplify systemic risks during market stress, as seen in several algorithmic trading incidents.

Global and Cultural Considerations

Regulatory Fragmentation: Different countries have varying approaches to regulating AI in finance, creating compliance challenges for global financial institutions.

Digital Divide: Ensuring equitable access to AI technologies to avoid exacerbating socioeconomic inequalities in financial services.

Conclusion: The Future of AI-Powered Trading Predictions

Artificial Intelligence-enabled real-time data analytics are revolutionizing financial market predictions with unprecedented accuracy and speed, unlike anything seen earlier. Using machine learning, NLP, and deep learning, financial services can achieve a much deeper understanding of market dynamics, positioning them to make more informed decisions through advanced AI-powered trading predictions.

As technology advances, artificial intelligence will increasingly prevail in predicting trends in the financial world. How AI platforms analyze financial market trends continues to evolve with the integration of generative AI, large language models, and multimodal learning systems that can process text, numerical data, images, and even audio simultaneously.

Key Trends Shaping the Future

- Quantum AI Integration: Quantum computing combined with AI will enable processing of vastly more complex market scenarios and risk calculations.

- Explainable AI: Increasing regulatory pressure will drive development of more transparent and explainable AI prediction models.

- Edge Computing: Processing real-time data closer to the source will reduce latency in high-frequency trading to nanoseconds.

- Democratization: AI-powered trading tools will become increasingly accessible to retail investors through user-friendly platforms.

- ESG Integration: AI will incorporate environmental, social, and governance (ESG) factors into trading predictions and portfolio management.

Getting Started with AI in Financial Analysis

Understanding how does AI in financial analysis work with real-time data is the first step. Organizations looking to implement AI-powered trading predictions should:

- Assess Current Infrastructure: Evaluate existing data pipelines, computing resources, and technical capabilities.

- Start with Specific Use Cases: Begin with focused applications like sentiment analysis or risk management rather than comprehensive overhauls.

- Invest in Talent: Build teams with expertise in machine learning, quantitative finance, and data science.

- Prioritize Data Quality: Clean, structured, and comprehensive data is the foundation of effective AI prediction models.

- Implement Robust Governance: Establish clear policies for model validation, risk management, and ethical AI use.

To stay ahead in the fiercely competitive finance market, your forecasts must remain fresh. Attaining AI predictive capability is critical to ensuring that your predictions are not only topical but also more accurate than others.