In boardrooms across the globe, generative AI has moved from curiosity to crisis point. The question is no longer whether to adopt generative AI but how to transform it from a collection of experimental tools into a genuine strategic capability that reshapes competitive advantage.

The statistics are compelling: McKinsey reports that 65% of organizations are now regularly using generative AI, nearly double the percentage from just ten months ago. Yet most implementations remain tactical, department-level experiments that generate impressive demos but fail to fundamentally change how organizations create value.

This article provides a framework for executives who recognize that enterprise generative AI success requires fundamental shifts in how organizations think about technology, competitive positioning, and organizational capabilities.

The Strategic Blind Spot: Why Most GenAI Initiatives Fall Short

The typical enterprise generative AI strategy follows a predictable pattern: pilot a few use cases, measure productivity gains, declare success, and scale horizontally. This approach treats GenAI as a productivity multiplier, a better spell-checker, a faster code completion tool, a more eloquent email writer.

The problem isn't that these applications lack value. The problem is that they're profoundly non-strategic. They don't create defensible advantages, reshape industry dynamics, or fundamentally alter your organization's capabilities.

| Tactical GenAI Thinking | Strategic GenAI Capability |

|---|---|

| Individual productivity tools | Transformed business processes and operating models |

| Department-level pilots | Enterprise-wide capability infrastructure |

| Off-the-shelf commercial APIs | Proprietary models fine-tuned on unique data assets |

| Cost reduction focus | New revenue streams and market positioning |

| Technology implementation project | Organizational transformation initiative |

| Easily replicable by competitors | Defensible competitive advantages |

The Four Strategic Questions Every Executive Must Answer

Building GenAI as a strategic capability requires honest answers to four fundamental questions that most organizations avoid:

1. Where Does Generative AI Create Asymmetric Advantage in Our Industry?

Not all GenAI applications are created equal. Some offer marginal productivity gains easily matched by competitors. Others create compounding advantages that become increasingly difficult to replicate. Strategic GenAI applications typically fall into three categories:

- Data Network Effects: Systems that improve with proprietary usage data, creating barriers to entry;

- Process Reinvention: Using GenAI to do things fundamentally differently, not just faster;

- Customer Value Multiplication: GenAI that makes your core product exponentially more valuable.

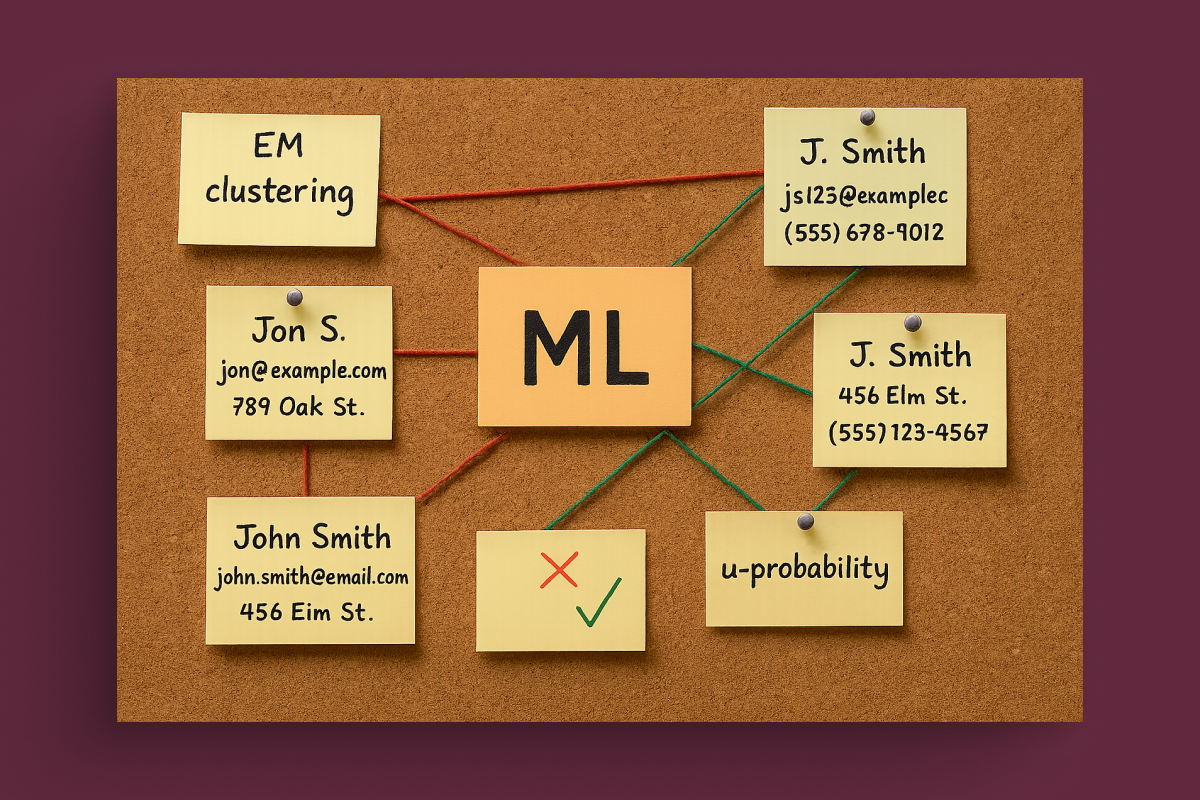

2. What Proprietary Assets Can We Leverage That Competitors Cannot?

The commoditization of base models means that strategic advantage increasingly derives from what you feed them, not which ones you use. According to Harvard Business Review's analysis, organizations with unique, high-quality proprietary datasets are seeing 3-5x higher returns from GenAI investments compared to those relying solely on general-purpose models.

Your strategic GenAI moat likely comes from:

- Proprietary data: Customer interactions, operational metrics, domain expertise captured in documents;

- Workflow integration: How deeply GenAI can embed in processes competitors don't have;

- Specialized knowledge: Industry-specific terminology, regulations, and context;

- Feedback loops: Systems that learn from outcomes unique to your operations.

3. Build, Buy, or Control: What's Our Strategic Posture?

Perhaps the most consequential decision executives face is determining where to position your organization in the GenAI stack. This isn't just about technology, it's about competitive positioning and long-term strategic control.

Strategic Posture Framework

- Infrastructure Layer (Foundation Models): Few organizations should compete here. The economics favor concentration;

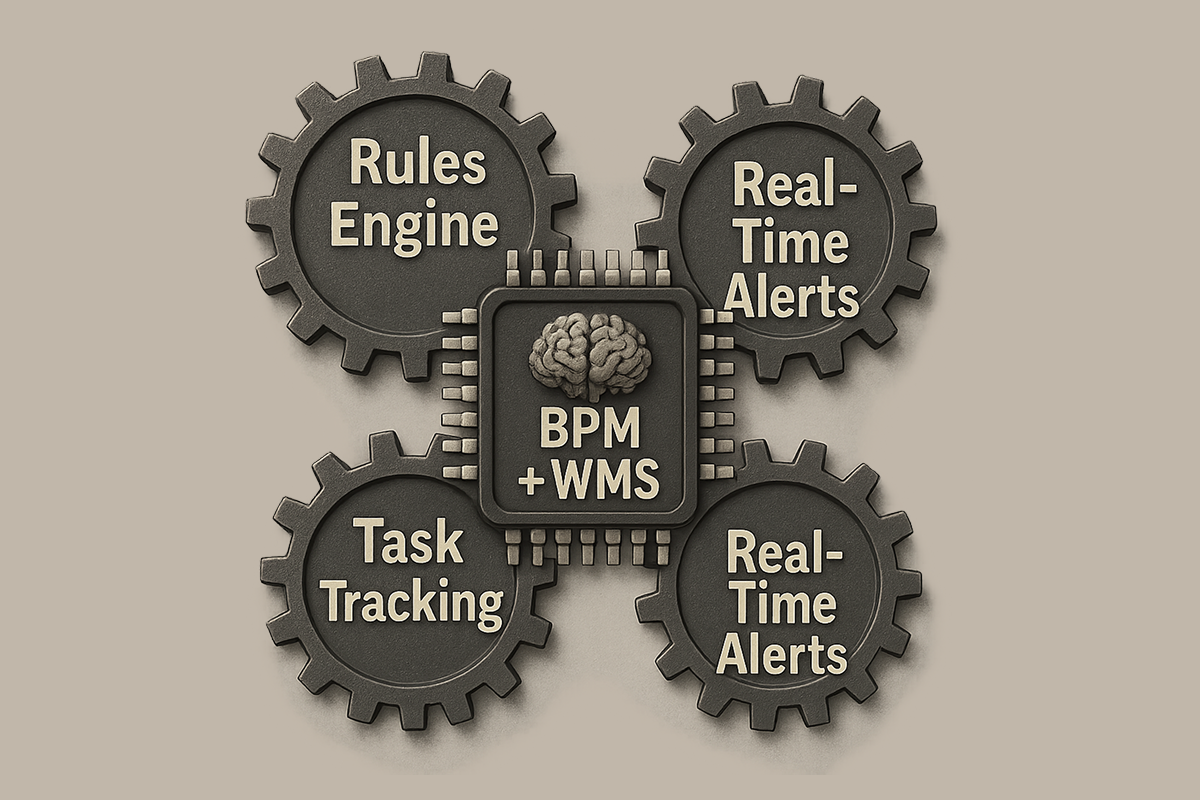

- Application Layer (Fine-Tuned/RAG Systems): This is where most strategic value creation happens. Organizations can build defensible positions through proprietary data and domain expertise;

- Integration Layer (Workflows & Processes): The most underestimated opportunity. How GenAI connects to your unique operational context often matters more than the models themselves;

4. How Do We Govern Without Stifling Innovation?

The final strategic question addresses the tension every executive feels: how to move fast enough to capitalize on GenAI's potential while managing unprecedented risks around data privacy, regulatory compliance, and reputational exposure.

Most organizations default to one of two extremes, either permissionless experimentation that creates massive risk exposure, or centralized governance so restrictive it prevents any meaningful progress.

| Risk Category | Strategic Governance Approach | Common Mistakes |

|---|---|---|

| Data Privacy | Tiered data classification with clear usage boundaries | Blanket restrictions that prevent all innovation |

| Model Reliability | Human-in-the-loop for high-stakes decisions | Requiring perfect accuracy before any deployment |

| Compliance | Built-in compliance by design, not bolt-on reviews | Multi-month approval processes for every use case |

| Vendor Lock-in | Abstraction layers and multi-model strategies | Complete dependence on single commercial provider |

From Strategic Intent to Operational Reality: The Implementation Challenge

Strategy without execution is hallucination. The distance between recognizing GenAI's strategic potential and actually building strategic capabilities is where most organizations stumble.

The challenge isn't technical complexity, it's organizational. Building enterprise generative AI capabilities requires coordinating across traditional silos, establishing new roles and responsibilities, and fundamentally changing how teams work.

The Azati Approach: Strategic Partnership for GenAI Transformation

This is where Azati's 25 years of experience building complex digital systems for enterprises becomes strategically valuable. Unlike consultants who provide recommendations or pure-play developers who write code, Azati operates as a strategic implementation partner who bridges the gap between executive vision and operational reality.

Building Competitive Moats in the GenAI Era

As GenAI capabilities democratize, the question of sustainable competitive advantage becomes more urgent. If everyone has access to similar foundation models, where do lasting advantages come from?

The answer lies in understanding that GenAI advantage isn't about the technology itself,it's about how the technology integrates with and amplifies your organization's unique assets and capabilities.

| Advantage Type | Durability | Strategic Value |

|---|---|---|

| Using latest commercial models | Low (weeks) | Commodity parity |

| Custom prompts and workflows | Medium (months) | Temporary efficiency gains |

| Proprietary fine-tuned models | High (years) | Defensible differentiation |

| Data feedback loops | Very High (compounding) | Increasing returns to scale |

| Transformed business models | Strategic (persistent) | Industry repositioning |

The Organizational Transformation Imperative

Perhaps the most overlooked aspect of strategic GenAI adoption is that technology is the easy part. The hard part is organizational change.

Building GenAI as a strategic capability requires:

- New roles and responsibilities: Who owns AI strategy? Who evaluates model outputs? Who manages vendor relationships?;

- Changed workflows: Processes designed for human execution often need fundamental redesign for human-AI collaboration;

- Different skills: Not just technical AI skills, but the judgment to know when to trust AI outputs and when to override them;

- Cultural shifts: Moving from "AI will replace us" fear to "AI amplifies our capabilities" mindset;

- Investment reallocation: Strategic GenAI requires sustained investment, not just project budgets.

The Strategic Choice: Leader or Follower?

The window for establishing strategic GenAI positioning is narrowing. According to BCG research, organizations that establish GenAI capabilities early see 2-3x higher returns than fast followers, and 5-10x higher returns than laggards.

The difference isn't just timing, it's about whether you're building strategic capabilities or copying competitors. Fast followers can replicate tools. They can't replicate the organizational capabilities, proprietary data advantages, and transformed business models that leaders are building.

The Executive Decision Matrix

- If GenAI creates asymmetric advantage in your industry: You need strategic capability development, not tactical pilots;

- If you have unique proprietary data assets: Commercial APIs alone will leave value on the table;

- If competitors are building strategic GenAI: Tactical implementations won't maintain competitive parity;

- If your organization lacks internal AI expertise: Partner with firms who combine strategic thinking and technical execution.

Conclusion: Beyond the Hype to Strategic Reality

Generative AI represents the most significant technological shift since mobile computing. But like mobile, cloud, and the internet before it, the organizations that win won't be those who adopt first, they'll be those who think most strategically about how new capabilities reshape competitive dynamics.

The difference between generative AI as productivity tools and enterprise generative AI as strategic capability comes down to how executives frame three questions:

- Not "How can we use GenAI?" but "Where does GenAI create asymmetric advantage?"

- Not "What models should we use?" but "What proprietary assets can we leverage?"

- Not "Should we move fast?" but "How do we govern strategically while moving fast?"

Organizations that answer these questions thoughtfully, and execute with experienced partners who understand both strategy and implementation, will define the next decade of competitive advantage in their industries.

Those that continue treating GenAI as just better productivity tools will find themselves increasingly outmaneuvered by competitors who recognized it as the strategic inflection point it truly is.