Up to this day, Artificial Intelligence was only a buzzword that helped startups and media gain more interest. But now it is a technology implemented by global businesses in various industries. AI changes the way we perform day-to-day tasks.

Artificial Intelligence can do a lot of fascinating things: take better selfies, create realistic portraits of non-existent humans, power intelligent chatbots, extract data from on-paper documents, detect insurance fraud, and etc.

Moreover, AI-powered business tools allow companies to make better data-driven decisions. This technology improves our lives significantly, and it’s time to implement it in many areas of human activity.

One of the domains that can benefit from AI is insurance. Adopting Artificial Intelligence brings advantages for both companies and their customers. It can simplify claims processing for adjusters and make settlement quicker and more transparent for clients.

What Is Claim Settlement?

A claim settlement is a form of agreement between parties that allows handling insurance disputes. Settlements take place when the policyholder suffers some loss or damage which is covered by the insurance company. This is usually the case with car accidents or personal injury claims. The policyholder files a complaint to get the amount of money specified by the insurance agreement and meet hospital or repairing service expenses.

The insurance company reviews the claim and decides whether it gets approved or not. There are a lot of different nuances that impact the final decision. Sometimes companies would even initiate an investigation to make sure that the occasion took place and check whether the repairing or healing estimates were calculated correctly. The insurance company aims to eliminate fraud.

How Can Be Used Ai For Claims Settlement?

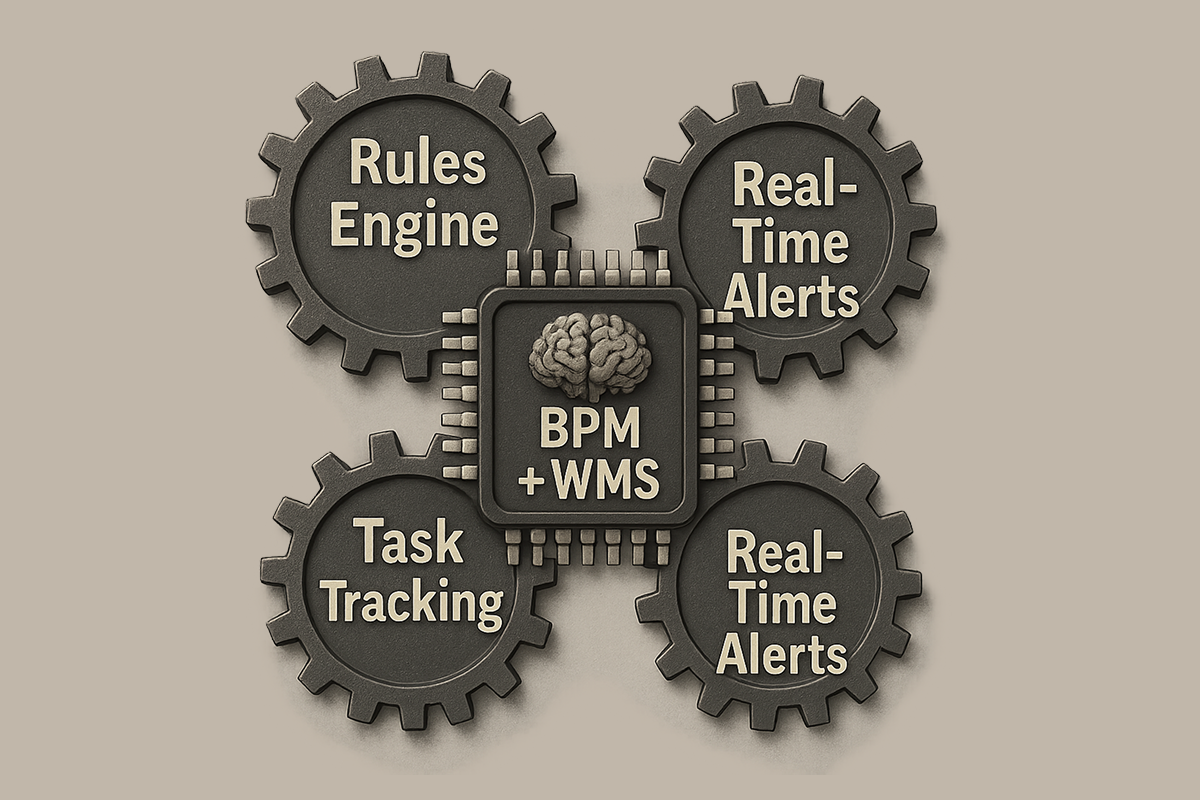

People often see Artificial Intelligence as a tool that organizes data. And it is true – AI has an incredible data processing capability and allows creating a complex and convenient environment where both businesses and their clients can interact with the information.

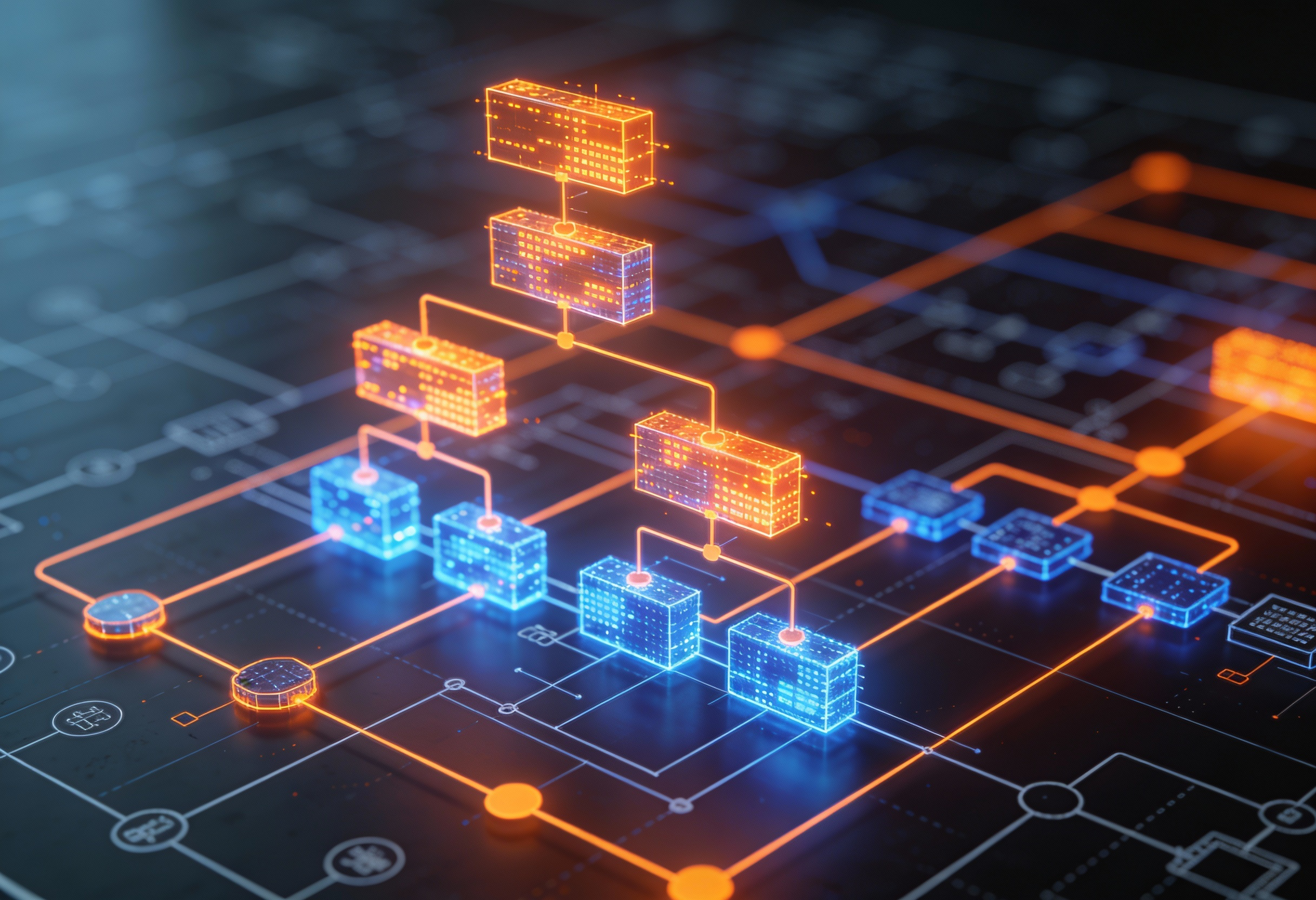

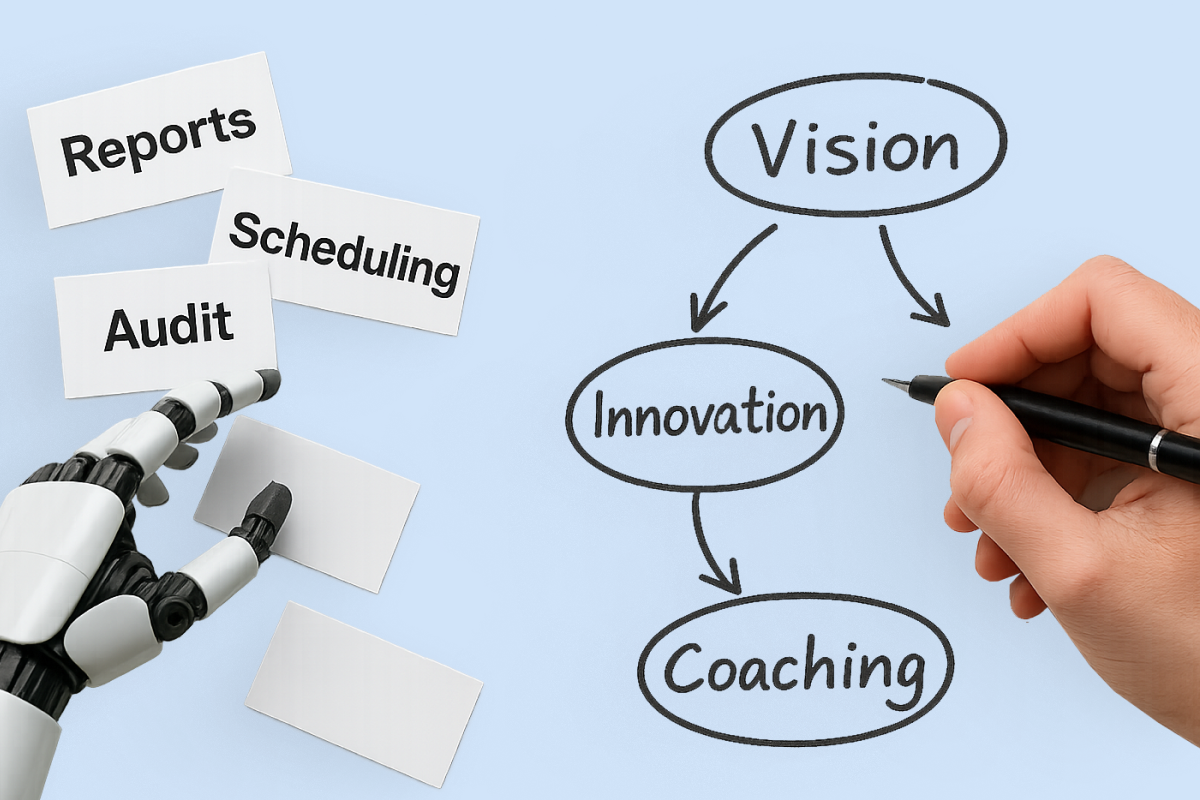

There are other benefits of AI. It can nearly eliminate unfair insurance claims settlement. First of all, the insurance company can implement AI-based chatbots in the workflow. It will automatically process requests and interact with the client. Intelligent chatbots can simplify the conversation and make communication with the client more effective and stress-free. Automated conversational agents can process clients information on the go. Such an approach significantly decreases the amount of time needed to analyze data and make a decision.

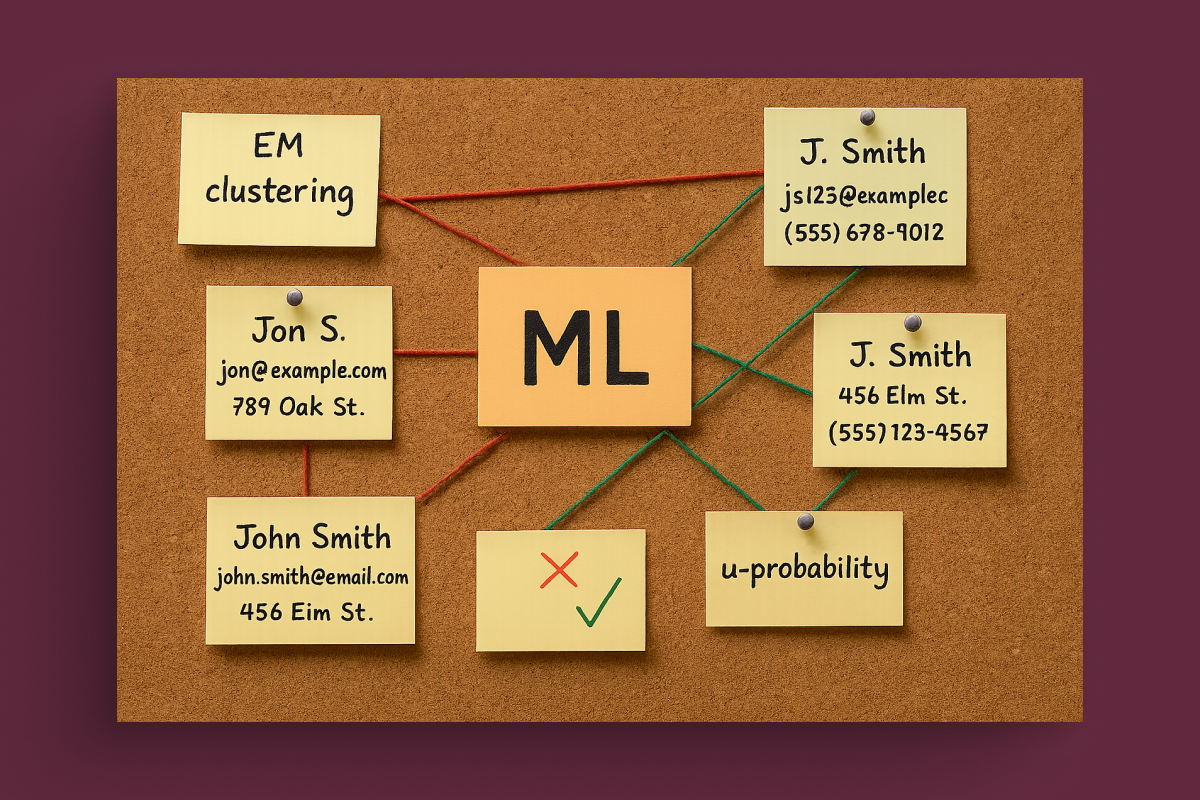

The customer files the claim to the bot with all the evidence attached. The bot will collect the data and update the information in the system. But the most amazing thing is that Artificial Intelligence gives bots an ability to review the claim and score fraud possibility. AI can learn from sample data sets; and if trained with industry-specific information regularly, it can start recognizing fraudulent patterns in incoming claims. Insurance companies can create algorithms that will help bots detect scam cases utilizing underwriters’ experience.

Similar algorithms and mathematical models can save clients from different confusions too. As the bot processes the claim, we not consider the human factor.

What Is A Customized Claims Settlement?

There are standard-setting organizations, both local and international, that regulate the way insurers operate. For example, the US insurance companies comply with the laws that are defined by the NAIC – the National Association of Insurance Commissioners. It sets requirements for insurance companies and creates uniform regulations. While these laws make things more comfortable and transparent for companies themselves, they are often not customer-oriented.

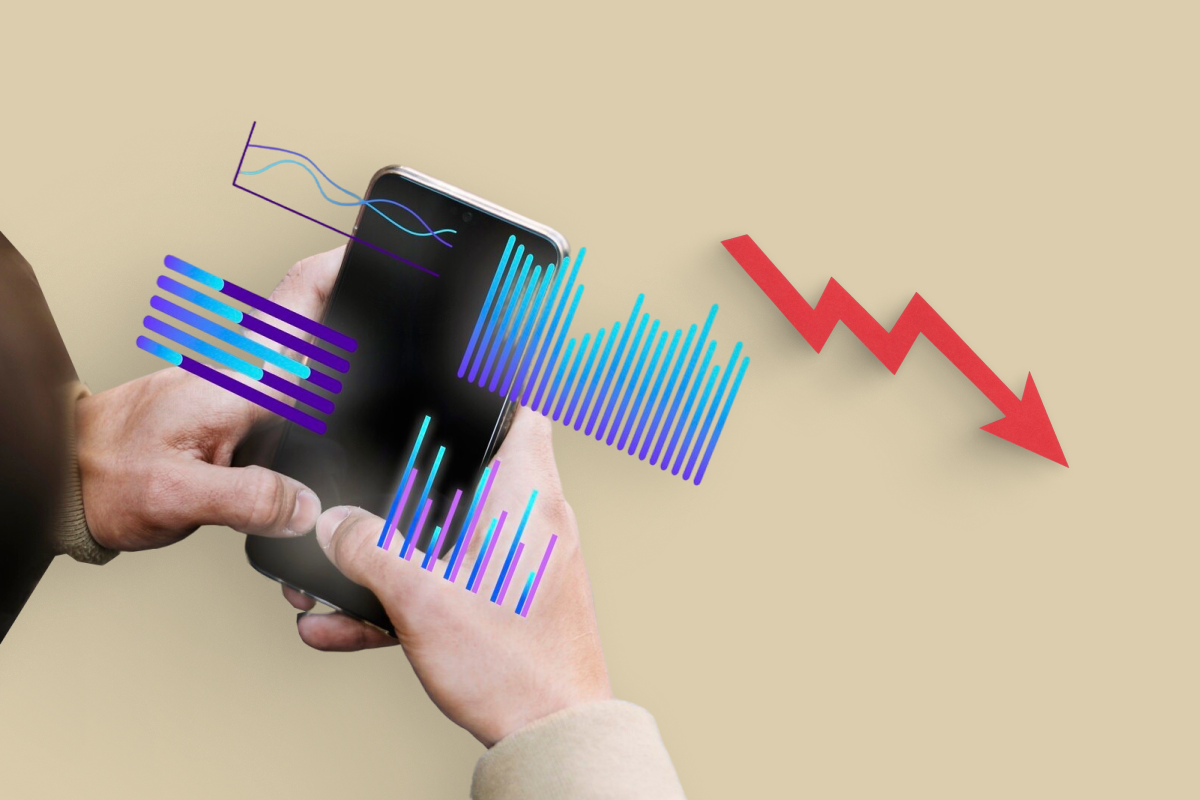

If a client needs car insurance, the policy premium amount depends on day-to-day car usage. But there is a common situation when a policyholder starts driving more often than regular home-work-home trips. Such drivers have more chances to get into an accident than the one who drives only on occasion.

Since insurance companies rely on the expected car usage data to calculate policy premiums, such situations could result in unplanned losses for them. Such unfairness forces both frequent and occasional drivers to pay the same policy premiums. Wouldn’t it be more logical and fairer to make the premium higher for those who drive more?

While it sounds complicated to execute, the solution is straightforward. All the policyholder has to do is install a telematics unit in the car.

Such a unit can track how careful the driver is, and the insurance company can adjust the premium based on this data. Everyone can agree to the fact that more careful drivers should pay less for the insurance policy.

It is a win-win approach for both parties. Insurance companies will get more money from those who get in accidents often and need frequent repairs. And careful car owners will pay lower premiums saving extra money. Such rules will also make policyholders more attentive, and as a result make the roads safer.

Artificial Intelligence can analyze the telematics data extracted from the lifestyle of customers. Predictive analytics software can use these data to determine the risk factors.

Finally, the best feature of Artificial Intelligence is that it allows us to make the service as personalized as possible. Clients today look for customized deals that will be personalized and unique. In the reality of the modern oversaturated insurance market, companies have to survive, and the simplest way is to offer a service with a personalized touch.

Other Benefits Of AI For Claims Settlements

Applying AI could undoubtedly improve many aspects of insurance company operations. But there is much more Artificial Intelligence can do for insurance companies. It can help bring this industry to a new level and attract even more clients.

For example, some companies provide not only insurance services but smart home monitoring as well. Customers install sensors in their houses that will control the environment. Telemetric sensors and artificial intelligence cannot eliminate all the accidents, but can significantly decrease the probability. AI can determine anomalies and alert property owners to avoid future accidents.

Once the sensor detects an issue, the system automatically alerts the customer and contacts the insurance company. Most often, the support offers to send someone to fix the problem with the insurance covering all the expenses. It is incredibly convenient, and people are ready to pay more money for personalized service.

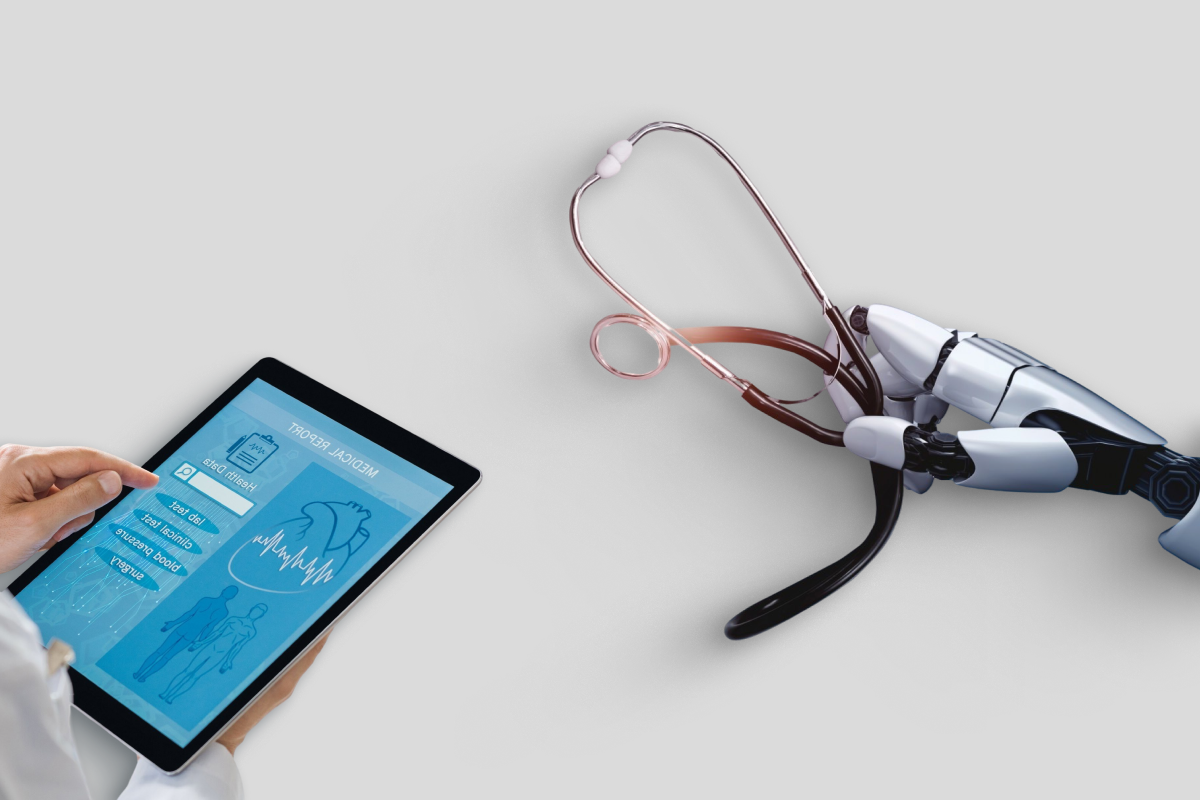

With all the wearables, health insurance becomes more intelligent. Predictive analytics powered by Artificial Intelligence opens up many opportunities for health insurance. For instance, insurance companies can create a rewarding preemptive care system that will encourage clients to maintain healthier lifestyles. Healthier people will generally have less health insurance claims

Conclusion

It is hard to underestimate the importance of Artificial Intelligence in Insurance claim settlement. This technology can greatly improve the insurance industry, simplify routine processes and take care of mundane tasks. We can only anticipate the positive changes AI will trigger in the near future. And we will see the difference quite soon.

There already are insurance companies and other businesses that implement Artificial Intelligence in their workflows creating better, more personalized offers for their clients and winning the competition.

Since AI is still on its rise, now is the best time to think about applying it to your workflow. The earlier you start using AI, the more advanced it becomes as it learns continuously. Keep in mind that clients are becoming more demanding when it comes to services.

Ready to revolutionize your claims process with AI? Start building smarter, faster, and more personalized insurance experiences today.