All Technologies Used

Motivation

The client wanted to fully automate the loan issuance process, eliminate paperwork, reduce manual errors, and provide customers with a fast, intuitive way to apply for loans both in malls and bank offices. The goal was to improve customer satisfaction, streamline internal workflows, and ensure scalability and consistency across all branches nationwide.

Main Challenges

Customers faced long waiting times at mall counters and manual verification delays. Azati developed a mobile application integrated with the Decision Making System (DMS), using QR codes, SMS confirmations, and digital signatures to enable instant loan approval and reduce customer waiting time.

Bank employees had to navigate multiple systems and manually process documents, which was error-prone and slow. Azati created a unified platform that consolidated all internal systems, automated data processing, PDF generation, digital signing, and interaction with third-party services, reducing errors and manual workload.

Deploying the new system to all bank branches without losing stability and performance was challenging. Azati implemented a microservices architecture with 37 services supporting both mobile and web applications, ensuring scalable, reliable, and maintainable deployment across all locations.

Our Approach

Want a similar solution?

Just tell us about your project and we'll get back to you with a free consultation.

Schedule a callSolution

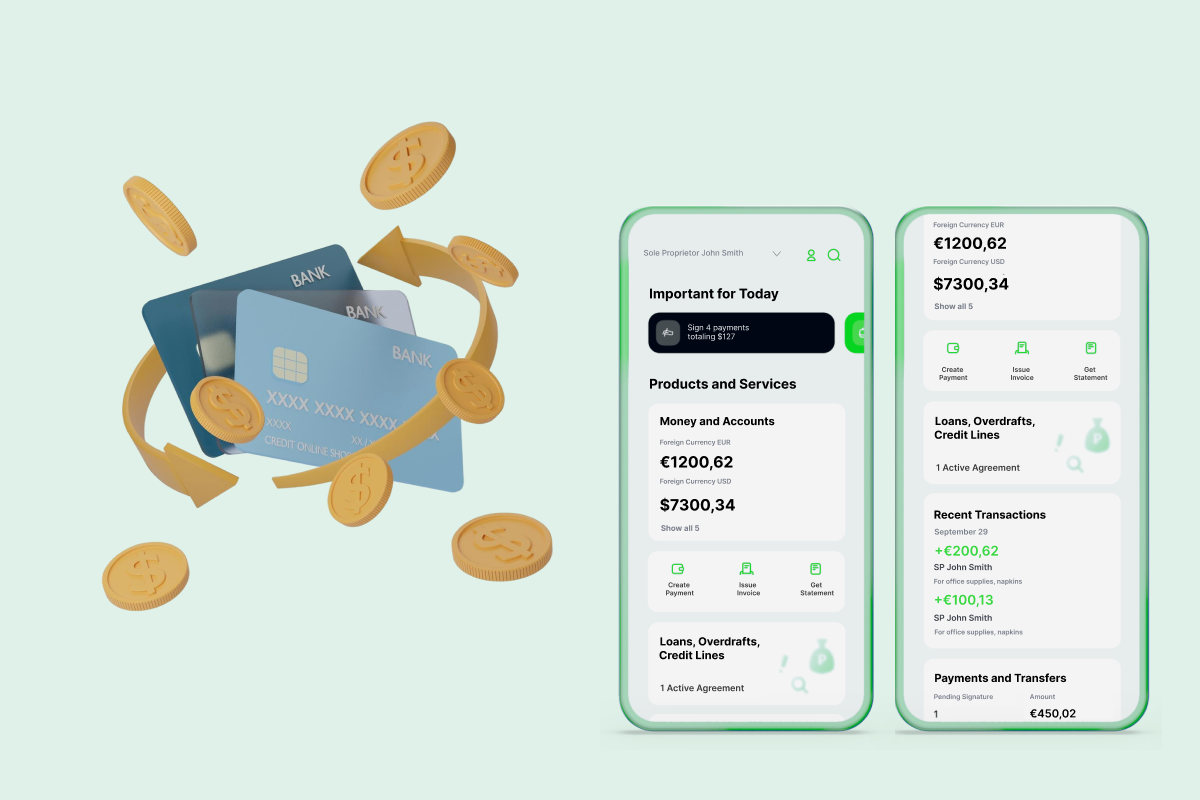

Real-Time Loan Application Mobile App

- Real-time loan application submission

- Secure customer verification via QR code or biometric authentication

- SMS and email notifications for status updates

- User-friendly interface for faster processing

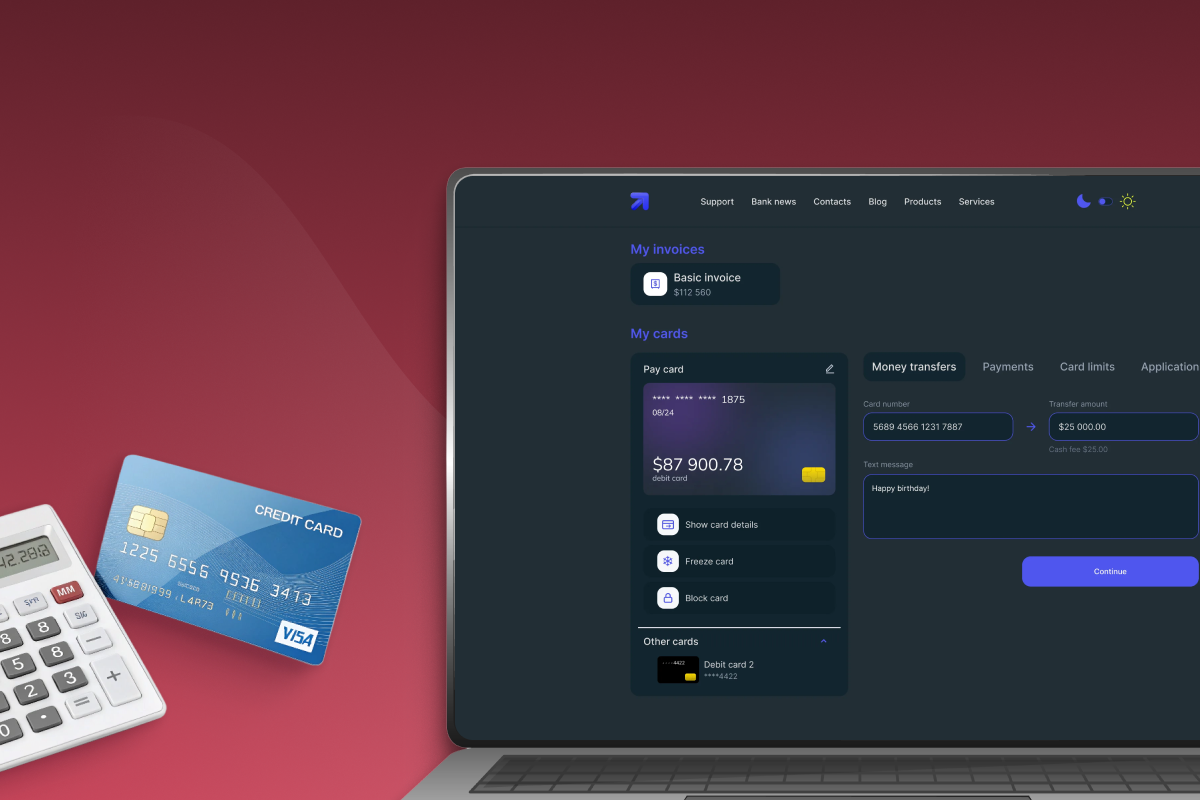

Unified Loan Processing Platform

- Integration of multiple internal banking systems

- Real-time interaction with Decision Making System (DMS)

- PDF generation and digital contract signing

- Scalable to all branches nationwide

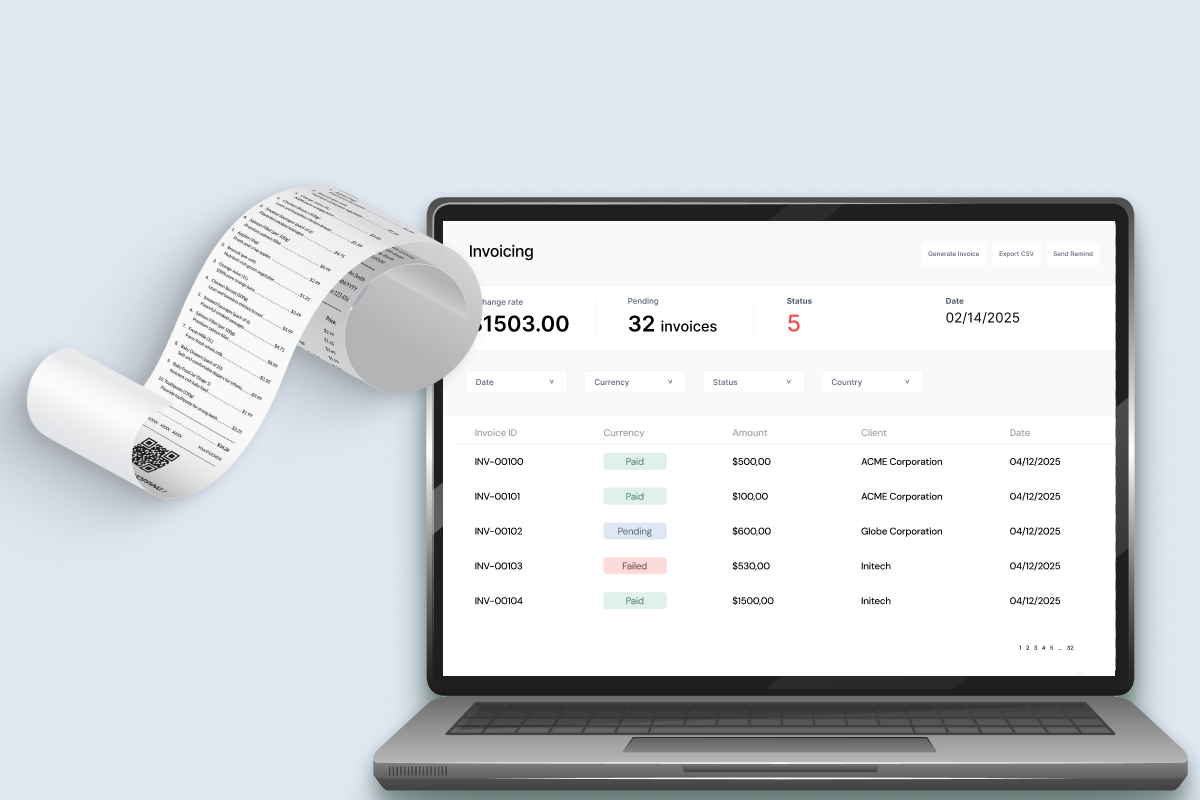

Document Automation and Digital Signature

- Automatic PDF generation for contracts

- Integration with digital signature systems

- SMS-based document confirmation

- Secure storage and retrieval of signed documents

Microservices Architecture

- Scalable and maintainable microservices design

- Efficient processing of user and loan data

- Integration with third-party payment and banking services

- Support for mobile and web clients

Analytics and Reporting

- Track loan processing speed and approval rates

- Monitor error reduction and operational efficiency

- Generate reports for selected periods

- Identify bottlenecks and optimize workflows

Business Value

Reduced Manual Effort: Automation and system consolidation minimized repetitive tasks for employees, reducing errors and processing time.

Faster Loan Approvals: Real-time mobile application and DMS integration enabled quicker loan approvals for customers.

Scalable Nationwide Solution: Microservices architecture allowed deployment across all bank branches without loss of reliability.

Improved Customer Experience: Mobile-friendly processes and digital signatures provided a seamless, paperless application journey.