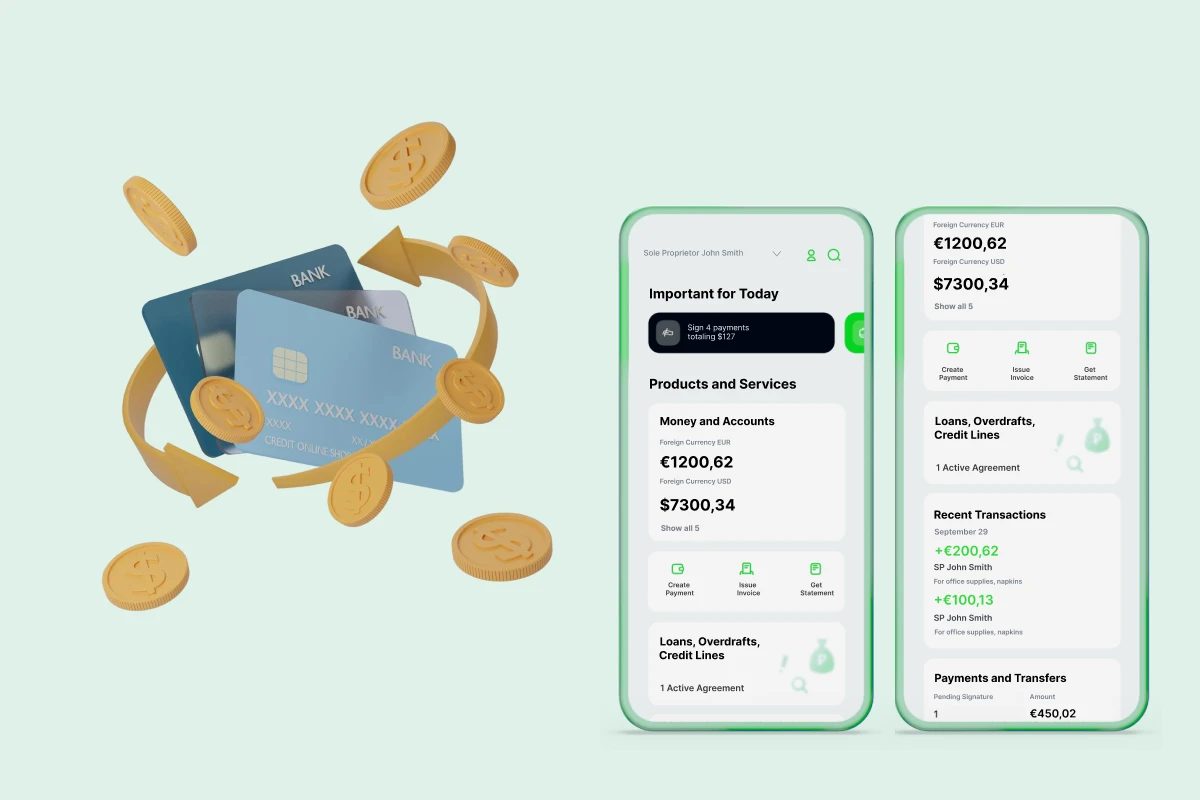

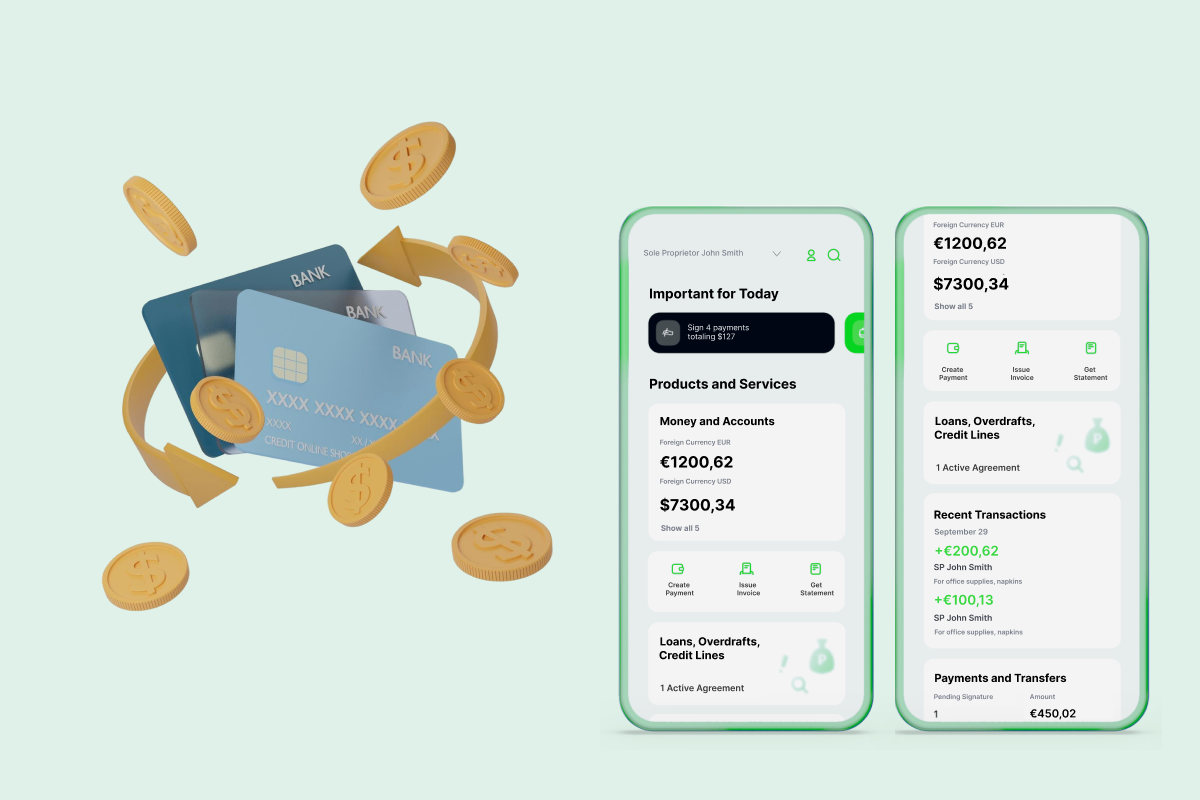

Enterprise Banking Platform

⚡ Pain Points We Tackled

The client, a financial institution targeting small- and medium-sized enterprises (SMEs), needed a modern banking platform that would support multi-channel payment creation, display of account and card information, comprehensive transaction history, and multi-format reporting for the SME segment. The legacy system struggled with complex workflows, high error rates in payment processing, and slow settlement times that frustrated business users.

Our Approach

Azati’s team performed a full audit of existing SME-payments workflows, defined clear user journeys for payments across channels (web, mobile, API), and designed a responsive, scalable platform aligned with SME customers’ needs. We built intuitive interfaces for payment creation, account/card overview, and reporting modules. The architecture ensured efficient settlement, error-handling automation, and real-time updates for business users, enabling the bank to serve SMEs more effectively.

Applied Methods and Practices

- Business-flow mapping: Detailed task analysis of SME payment creation, approval, settlement, and reporting.

- Responsive UI/UX: Designed dashboard and workflows that show clearly the account, card, and transaction state for SME users.

- Workflow automation: Streamlined approvals, automated error-checks, and built settlement pipelines to reduce manual intervention.

- Scalable architecture: Modular design enabling handling of large SME volumes and future channels.

- Agile delivery: Iterative sprints to deploy features quickly, gather SME feedback, and refine workflows.

Solution Features

- Multi-channel payment creation: SMEs can initiate payments via web portal, mobile app, or API.

- Account & card info dashboard: Real-time display of balances, transactions, and spending patterns.

- Transaction history & reporting module: Business users access full history and export reports in multiple formats.

- Automated error detection and settlement tracking: Reduces the need for manual corrections and speeds up the process.

- SME-centric workflows: Tailored for business users rather than retail consumers, e.g., multiple approvals, templates, recurring payments.