The Coalition Against Insurance Fraud states that at least $80 billion in fraudulent claims are made across all lines of insurance annually in the U.S. Undoubtedly, the real figure is even larger, since many of fraud cases have gone undetected. But even these estimates make insurance fraud the second largest economic crime in America, exceeded only by tax evasion.

The following actions are classified as insurance claim fraud:

- staged accidents, thefts, injuries, arsons or other types of loss,

- exaggeration of a genuine claim,

- intentional omission of essential information on an application,

- submission of false information on an application.

All lines of insurance suffer from fraud, with the automobile, workers’ compensation and health insurance heading the list of the most common in terms of frequency and average cost. Can we use Artificial Intelligence to fight Insurance Fraud? Let’s discover!

CAUSES AND CONSEQUENCES OF INSURANCE CLAIMS FRAUD

Some cheaters mistakenly perceive claim fraud as a high-reward, low-risk harmless trick. Unfortunately, they are partially right, as the prosecutors often give top priority to fighting high-profile crimes, such as violence. Some insurers prefer to pay certain suspicious claims, as they believe it’s cheaper than to initiate legal proceedings.

Some cheaters think of insurance fraud as some victimless and harmless scam, which imposes costs only on insurance companies. But there are several related problems, not obvious at the first sight.

Other people’s health, lives and property aby insurance fraud schemes such as staged auto crashes, murder for life insurance, arson. On top of that, when insurance companies are cheated, the overall insurance rate percentages and premiums increase, so the people who honestly pay premium suffer greatly. According to the FBI statistics, insurance fraud costs the average U.S. family between $400 and $700 per year in the form of increased premiums.

HOW THE PROBLEM IS ADDRESSED WITHOUT ARTIFICIAL INTELLIGENCE

Insurance companies take measures to actively combat fraud. The prevailing majority of insurers (nearly 75%) opt for making use of anti-fraud programs to detect false claims. Also, some companies hire trained investigators.

Despite these actions, fraud losses continue to mount. More than 60% of insurers say fraud has climbed over the last three years, according to the Coalition Against Insurance Fraud.

ARTIFICIAL INTELLIGENCE AS AN INSURANCE FRAUD DETECTION SOLUTION

The introduction of cognitive technologies into the work of the insurance industry is drastically changing the situation for the better. According to Accenture, 75% of insurance executives believe artificial intelligence will provide significant industry changes in the next 3 years.

Indeed, the capabilities of Artificial Intelligence in Insurance fraud detection are enormous. By analyzing large quantities of data, it is able to reliably identify data patterns and therefore recognize the similar behaviour. Due to their self-learning abilities, artificial intelligence systems can adapt to new cases and further improve themselves over time. The technology is already finding its implementation across diverse industries, and the insurance is not an exception.

So, how may this technology be of help in combating fraud in insurance?

The artificial intelligence based system ced for finding out the attempts to deceive by submitting fraudulent claims.

By processing and analyzing huge amounts of disparate information, the system is able to reveal the connections between multiple factors. After being trained enough, it can detect fraud with high accuracy, based on the previously analyzed cases. The program helps to provide a clear description of why it regards a given claim to be fraudulent, and then transmit it for further investigation to human specialists.

The automated insurance claim fraud detection solution have the following benefits for insurance companies:

- Fraudulent cases are spotted with greater precision and within a shorter period of time,

- By sensing patterns between various claims, it uncovers hidden correlations, previously undetectable by the human eye,

- By the permanent review of existing claims, the program will discover new schemes of fraud.

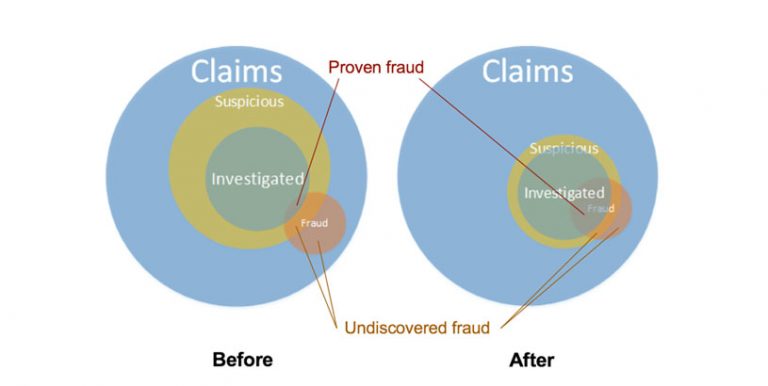

In 2016, Azati developed the artificial intelligence based software solution for automatic recognition of fraudulent claims. Previously, our client company viewed 10% of all claims with suspicion. After the implementation of our AI-system, the number of suspicious claims decrised to 5%. Nevertheless, the system classified 2.5% of all claims as “known fraudulent”, which means it discovered 3 times more fraudulent cases than before:

Suspicious – 10% of all claims

Investigated – 80% of suspicious claims (8% of all)

Known Fraudulent – 10% of investigated claims (0.8% of all)

Suspicious – 5% of all claims

Investigated – close to 100% of suspicious claims (5% of all)

Known Fraudulent – 50% of investigated claims (2.5% of all)

Let’s take a look at the example of how car insurance companies can benefit from artificial intelligence insurance fraud detection software.

The rate of fraud claims in car insurance is about 12%. Converting the percentage to our example, we have that the traditional ways of claim fraud detection would reveal 5% of the total number of claims, and the AI-based anti-fraud system would reveal 11%, which is fairly the precise number of the total fraud cases. Let’s suppose the insurer gets 100 of claims. For relatively minor injuries with no ongoing complications, the average settlement is around $20,000. We see that the company have to pay $2M for all the claims: both legitimate and fraudulent.

Without any fraud-detective techniques, the company would lose $240,000 paying it all to fraudsters; with application of traditional (with the help of investigators and/or basic fraud-detective software), the cheaters would get almost twice less – namely, $140,000. And the insurer, which is taking advantage of AI in their fraud fight would spend only $20,000 to scammers under these conditions meanwhile not paying $220,000 to the rest of the already detected scammers!

CONCLUSION

Insurance fraud imposes serious financial and personal costs on consumers, businesses and government, thus being sufficiently detrimental to the economy and society as a whole. Much has already been done to address the problem, but still much could be done.

The Artificial Intelligence anti-fraud programs provide great hope for improving the current situation. Though the solution doesn’t address the problem directly – some people would still try to cheat on their insurance policies, it contributes to fraud prevention at its initial stage. Also, the preventative effect is enhanced by a deterrent one, as the implementation of such an elaborate technology would turn some of the potential scammers off. This way, deploying the innovation in the insurance industry would make it much harder for them to succeed and promises to battle the problem in the most effective way for now.