It is hard to imagine a more suitable domain for artificial intelligence than Stock Trading. Statisticians have been cleansing and storing financial data for years to make software predict the optimal investment opportunities. And now we can see the rise of disruptive technology that may well become a game changer in the field. This technology is machine learning.

In this article, we will describe the very general information about the impact of machine learning on Trading and Stock Price Investment. If you want us to cover additional facts related to this topic – drop us a line, and we will update the article.

TABLE OF CONTENTS:

– Why is machine learning disrupting Trading and Stock Investment?

– Why do companies use machine learning to build automated trading strategies?

– How do automated trading strategies actually work?

– FACT: AI strategies often outperform human traders and typical trading software

– Why do huge market players rely on machine learning?

– What do the experts say about AI integration in automated trading?

– Are there any successful case studies of AI-based system integration?

– Summary

WHY IS MACHINE LEARNING DISRUPTING TRADING AND STOCK INVESTMENT?

More and more companies are willing to invest money in artificial intelligence and machine learning. In 2019, more than 250 fintech startups have been launched, and about 15% of them aim to automate trading with artificial intelligence. Angel investors find AI promising and easily provide young companies with millions in funding.

Automated trading systems powered by machine learning and artificial intelligence have become truly useful. Both corporations and individuals use AI-powered tools to make accurate data-driven decisions and gain valuable insights. This software facilitates the investment process, risk evaluation, stock price prediction, and day-to-day trading.

Machine learning is a sought-after technology for trading and stock exchange companies.

It’s no surprise that seasoned traders have been relying on tech solutions when making investment decisions for a long time. Due to their outstanding capabilities, industry-specific computer programs have been used to make thousands of trades in a second. Nowadays, however, typical software is becoming a thing of the past, while AI-based software solutions are gaining more recognition by traders and stockbrokers.

Some of the reputable hedge funds and investment companies already use artificial intelligence and machine learning in trading. The likes of Renaissance Technologies, Hudson River Trading, Two Sigma, Bridgewater Associates are highly successful in their automated trading strategies.

AI-based systems have helped their early adopters generate high returns; many investors and traders are now turning their eye on the technology. So, it’s time to think over the place of AI in the stock prediction software development and stock market investments.

As there are many great examples of how we can use machine learning in finance, we will briefly describe only automated trading. Read on to learn how AI and ML solutions help in stock trading automation.

WHY DO COMPANIES RELY ON MACHINE LEARNING TO BUILD AUTOMATED TRADING STRATEGIES?

Even experienced traders sometimes make emotional investment decisions. These emotion-based choices are the main deterrent to better performance. Trading applications, on the other hand, make intelligent choices based on data, and perform trades much faster than any human could do. But another way to avoid unexpected losses is to determine a trading strategy and follow it.

As there are many investment strategies, there are also dozens of different software algorithms for implementing a particular strategy. Let’s have a look at some of the most popular tactics to find out how machine learning and artificial intelligence can improve trading strategies.

THE MOST POPULAR DAY-TO-DAY INVESTMENT TECHNIQUES ARE:

– Following the trend. The application follows a specific pattern – it buys when the price increases and sells when it drops. This strategy works well if the trend persists and the price continues moving either downward or upward.

– Reverse investing. This strategy assumes that the upward trend will reverse and lead to the drop in rates. The application buys during the price fall and short-sells during the price rise, expecting that the trend will change.

– Scalping. The app earns you money exploiting small price gaps created by the bid-ask spread. This technique involves entering and exiting a position exceptionally quickly. The whole process takes minutes or even seconds.

– Hype trading. An algorithm buys when good news is announced and sells when terrible news appears. This strategy leads to greater volatility, which can lead to higher profits or losses.

However, stock trading requires more comprehensive strategies than the techniques mentioned above. Successful traders combine several trading strategies – both short-term and long-term – to build the one that will lead to the highest profit. Artificial intelligence solutions used in trading are built upon several layers of neural networks, and each layer implements a single trading technique.

HOW DO AUTOMATED AI-BASED TRADING STRATEGIES WORK?

All strategies are based on real-market data and traders’ experience. Even small-scale trading can be useful. It helps to understand the market: how it works, which factors affect the stock price, how to follow the market trend, etc.

Simply put, experience is a practical contact with and observation of facts or events. Experts analyze data collected during previous trading periods, try to build causal relationships and find correlations with the current market situation.

Artificial intelligence ‘thinks’ like a regular stock market investor. There is a dataset that was used by engineers to train the model. In other words, it is a bank of memory about stock market operations and facts that lead to the price change. According to this dataset, the model decides when to buy, hold, or sell. This dataset is a kind of “virtual experience” for artificial intelligence.

Without going into details, ML model training is quite straightforward – we build several layers and analyze information gained from different data sources: news, stock market trends, predictions, real-time operations, etc. As there are a considerable number of complex factors that can affect the stock market price, it is challenging to analyze all incoming data. It requires enormous computer power and bandwidth capacity.

The more data channels the machine learning tool analyzes, the more precise it becomes, and the more money it requires for initial training.

FACT: AI STRATEGIES OFTEN OUTPERFORM HUMAN TRADERS AND TYPICAL TRADING SOFTWARE

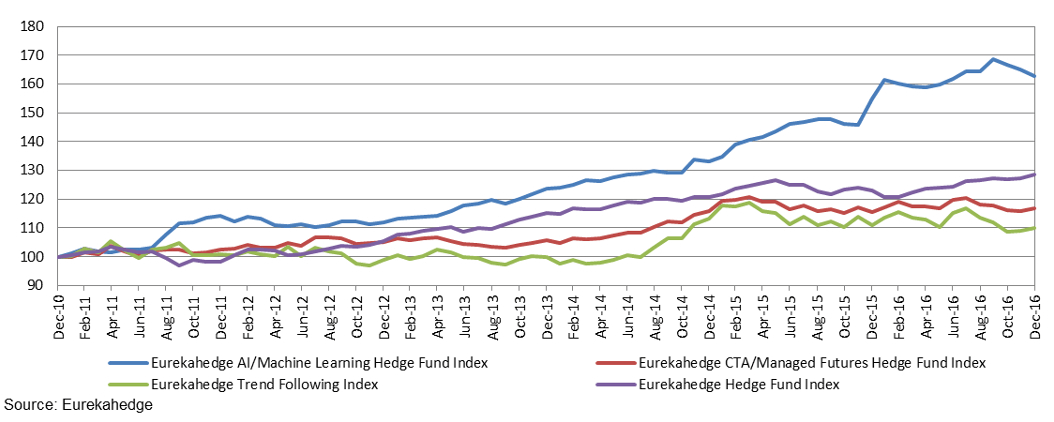

According to Eurekahedge, hedge funds that implement machine learning stock trading often outperform regular traders and the companies that use traditional algorithmic trading software.

As you can see, AI-driven hedge funds are doing pretty well. Eurekahedge provides performance stats as well. Here is the table from one of their reports:

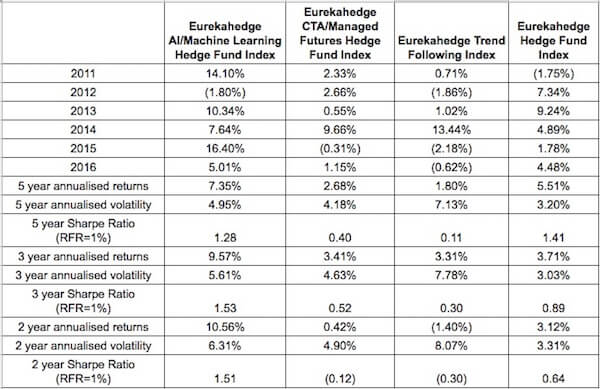

This table summarizes the performance statistics for AI/ML hedge funds along with their peers. Let’s briefly describe this table:

– AI/ML hedge funds outperform the global hedge funds year by year (excluding 2012);

– In 2011 and 2014, the returns of ML-based hedge funds were higher than those of traditional CTA/managed futures firms;

– Over the five, three- and two-year periods, AI/ML hedge funds outperformed global hedge funds delivering annualized gains of 7.35%, 9.57%, and 10.56% respectively;

– AI/ML hedge funds have also reported better risk-adjusted returns over the two- and three-year periods;

– While returns have been more volatile compared to those of the average hedge fund, AI/ML funds have shown low annualized volatility in trend following.

WHY DO HUGE MARKET PLAYERS RELY ON MACHINE LEARNING?

For years, trading companies have been trying to build specific applications to dominate the stock market. When algorithmic trading applications were first introduced, they quickly gained a solid market share and became extremely popular. Ten years ago, traders were introduced to brand-new tools for real-time trading; these tools provided thousands of people with a competitive edge and quickly boosted their profits. But what is so special about real-time trading tools?

If we compare a trader to a software application, we will find that they are entirely different. While traders analyze the market trend to make wise data-driven investment decisions, software is focused on making a considerable number of small operations according to a set of rules. These two approaches are entirely different. While the trader relies on a long-term strategy, real-time AI trading software development can help to earn profit on the spot.

Of course, we can’t deny the fact that making real-time operations is a handy feature the modern applications provide. But following this approach only, a trading company won’t earn much.

If we compare ML-powered apps to traditional trading software, we will quickly see the difference. ML applications combine the capabilities of both a trader and an algorithm. Such software has its own pre-trained ‘experience’ and is quick enough to make real-time operations.

SEVERAL FEATURES THAT MAKE MACHINE LEARNING AN ATTRACTIVE TECHNOLOGY FOR TRADING:

– Data processing speed. In trading, every second can cost a fortune – for you and your clients. There is no time to waste – anything can signal that a stock is about to rise or fall in price. And to make the right bet, these signals must be identified immediately. Without question, the processing speed of a computer is incomparable with that of a human.

Often, a machine learning model does not analyze data like traditional software does. Simply put, it compares the sample to the data from its ‘memory’ and provides accurate results. There are different model training techniques so the process can be slightly different too, but we hope you got the point.

The well-trained model often outperforms traditional algorithms when analyzing complex data. Processing speed makes a huge difference when the tool analyzes complex data from different sources like news, dividend announcements, investor behavior trends, demand and supply, etc. AI software scans financial reports and press releases for keywords, analyzes similar price movement patterns from the past, and comes up with the suggestion – and all this in a couple of seconds.

– Micro-trend discovery.

We already described how machine learning tools process data using multiple layers. Usually, one or more layers are responsible for trend analysis. It is quite simple to identify the overall current trend, but much more complicated to spot micro-trends.

To find out how micro trends affect day-to-day trading we suggest reading this book. Long story short, if a trading company discovers and follows a daily micro trend, it can quickly eliminate a considerable number of risks. Since a machine learning model is full of historical information gained through previous trading periods, it can help the company identify and adapt to trends as they develop.

– Long-term pattern discovery.

Powerful servers of the modern data centers process millions of operations per second. Thus, these computers can discover repetitive long-term patterns which developers always hide from the regular trader’s eye.

Artificial intelligence efficiently evaluates thousands of stocks in a matter of seconds and provides valuable trading insights. Well-known investors like Citigroup and Domeyard implement machine learning to decipher 300 million data points in the New York Stock Exchange’s opening hour of trading alone.

– Automated sentiment-based trading.

Artificial intelligence can analyze news stories to gain strategic insights. These insights can be beneficial for people who prefer trading the news.

The main difference between traditional algorithmic text analysis and machine learning is quite simple. Machine learning can understand what stands behind the words, while conventional algorithms usually analyze the text for specific keywords.

ML and AI often use comprehensive natural language processing techniques like entity detection, text embeddings, machine translation, dialogue and conversations interpretation, sentiment analysis, question answering, text summarizing, and more. These techniques make text analysis with machine learning much more intelligent compared to traditional algorithms.

There is also a huge number of different features that machine learning can equip stock trading with. So if you want to learn more – drop us a line, and we will provide you with details.

– Predictive power improves over time.

A large volume of quality data plus well-thought-out machine learning algorithms are the basis for an efficient AI-software solution. But there’s still room for improvement. Over time, ML systems become capable of self-learning without being explicitly programmed. As a result, this makes ML-based predictions even more accurate.

Unlike a human being, machines are devoid of any emotion. There is no room for emotions when making trading and investment decisions.

WHAT DO THE EXPERTS SAY ABOUT AI INTEGRATION IN AUTOMATED TRADING?

Yoshinori Nomura, a director at Simplex Asset Management, has spent over three years developing AI-based trading software.

It has already spotted wise investment opportunities. One of the most notable examples occurred in 2016 (the case is precisely described in the Bloomberg article). Nomura’s AI-based program sold off Japanese futures, which seemed to be the wrong bet. But soon Britain proclaimed they were going to leave the EU, which triggered a significant drop in the stock price. Simplex ended up with its best trading result in 3 months, whereas many funds had lost out.

The system makes decisions on whether to buy or sell futures twice a day. It is trusted to move up to as much as half of the fund’s value at any moment. In 2016, the system was reported to oversee no less than 3.5 billion yen, which was equivalent to $34.9 million.

One of the most significant advantages of the system is that it is able to adapt well to ever-changing market conditions: it combines ML and quantitative data, considers the market environment, market momentum and mean reversion at the same time. Y. Nomura reveals his secret: “Among several keys to success is a system that monitors the market environment and adapts strategy to fit current conditions best”.

ARE THERE ANY SUCCESSFUL CASE STUDIES OF AI-BASED SYSTEM INTEGRATION?

At Man Group, the third-largest hedge fund by assets under management, AI was initially looked upon with skepticism. But now they make it their cornerstone strategy. Company is investing massively in computer equipment and highly qualified computer engineers to ensure its technological growth.

The company was among the first to apply AI in trading. Though, it didn’t trust AI technology to manage its assets from the start. Moreover, due to the underlying principles of AI, no one including engineers could explain why AI software makes the decisions it makes.

After a series of testing efforts, the company experimented with their AI software by trusting it to handle a small sum of money from a managed portfolio. Then, they handed over more and more money to it. The system proved to be profitable. The firm became comfortable with the technology, and more importantly – confident with it. By 2015, the company’s AI-based system had been generating roughly half the profits for one of Man’s most significant funds.

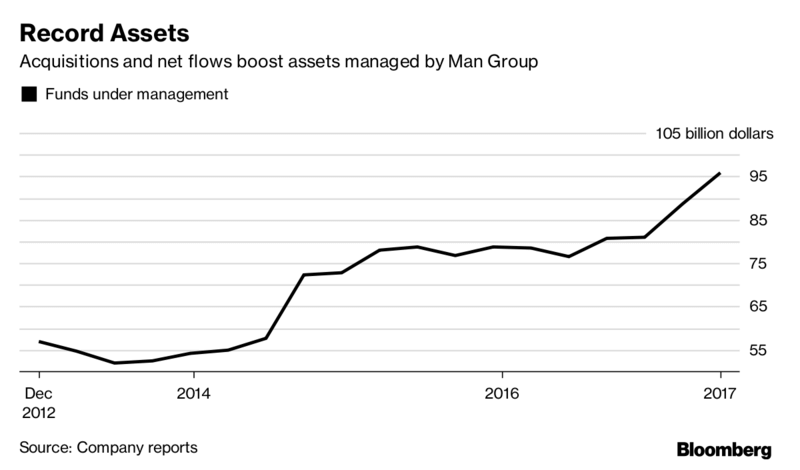

Four Man funds incorporating AI manage $12.3 billion in total. The AHL Dimension fund assets have quintupled. Meanwhile, the company’s assets under management have increased by 77% since the beginning of 2014:

Machine learning is much about prediction. It has already been applied to predict future customer behavior and proved to be successful.

But can it predict whether the price of stocks would go down or up? Yes, if an ML-based program is fed with all the necessary data, which signals the upcoming changes on the stock market. Still, we should take many factors into account, such as the company’s current earnings reports, new products, and acquisitions. External factors, such as news, economics, and politics trigger the market movements as well. ML can process this enormous bunch of data and reveal hidden patterns, which can be of much help when predicting the stock prices change.

Machine learning also brings value by looking at past price movements. Such insights pulled from the past, could be really helpful for analyzing the current market state and predicting future trends.

Computer software may perform the task multiple times, and the result would always be the same. Without human intervention, the program’s output won’t change. But the application of machine learning is a more advanced solution, as it has an excellent ability to self-learn over time. But do not think that if a program can educate itself, it could go out of control (other myths related to AI are busted here). It’s easy to set up the borders within which the software would operate.

What will the future of hedge funds look like? According to Bloomberg, 58% of managers think machine learning will have a medium to enormous impact on the industry. Now, traders are still in the early stages of incorporating this powerful instrument. As for now, the opportunity is still untapped, whereas some companies have seized it and enjoyed the benefits. Undoubtedly, it is only a matter of time when technology becomes widespread within the industry.

SUMMARY

Hopefully, this article has helped you get the main points about the advantages of machine learning and artificial intelligence for Trading and Stock Investments. Machine learning is a disruptive technology for these domains, so it is vital to understand how it works and what benefits it can provide for trading companies. Applying this technology can eliminate potential losses of tomorrow.

By the way at Azati Labs, our engineers developed an AI-powered prototype of a tool that can spot a stock market trend. Online trading applications may use this information to calculate the actual stock market price change. If you want to learn more – click here.